The below post is taken from the Video Blog, the Subject Matter Minute. You can view the episode on YouTube if you would like. Find it here: Episode #73 – Spotlight An Agency – Workforce Services

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view it on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello everyone, and welcome to the Subject Matter Minute. If you are a regular viewer, I’m guessing that you might have been thinking, “well, I guess that’s it… he must be done making these things.” Right? Well, it has been a long time… But, if you’ve been worried… the show will go on!

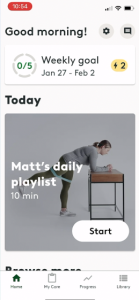

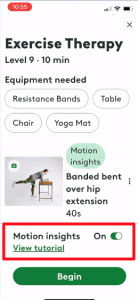

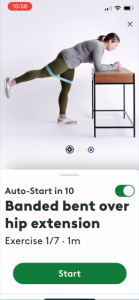

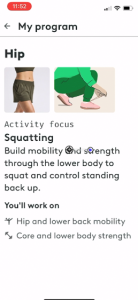

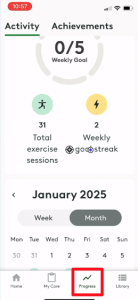

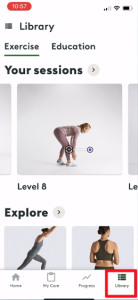

The last episode, all those months ago, was on Hinge Health, the service offered by EGI that allows you to do physical therapy and exercises through an app. If you missed the episode, or don’t know about it, check it out. It’s a great service.

As I mentioned in the episode, I am using it because my left hip had gotten somewhat sore and inflexible. I told you that I would give you an update. Well, it turns out, Hinge Health isn’t going to help my hip. After about 6 months of using the app, it wasn’t getting any better. My other hip and body in general were benefitting, but not the left one.

So… I finally got an x-ray. Yeah… it’s bone on bone and has some bone spurs thrown in just for fun. So, I guess at 55, I am shopping for a new hip. I have heard repeatedly that if you are going to replace something, the hip is the one to do…due to the quick recovery and general success of the procedure.

So… I don’t really want to hear any negative stories, but if you have positive experiences or advice to share about your hip replacement, and I’m sure there are a bunch of them out there, please throw them in the show notes! If you’d rather keep it private, throw me an email. I suppose it wouldn’t hurt to hear if there are doctors to avoid, but maybe keep that to an email so we don’t start a kerfuffle in the show notes!

Ok… enough about me!

Today I want to start an occasional one-off series about state agencies. If you are anything like me, you get the work done for your agency, but don’t really have much of an idea what others are doing in theirs.

I came up with a simple acronym, so everyone can remember the name of the series. I’m calling it What The Heck Does That Agency Do Anyway? Or simply WTHDTADA. See… easy to remember.

Today we are going to talk about Workforce Services. (music)

Before I dive in, I want to thank this episode’s Subject Matter Expert, Erin Turbitt and her team at DWS. They quickly got me what I needed to put this together. Thanks Erin!

The reason I’m starting with Workforce Services is because I attended a meeting where Chris Wiederspahn and Stacey Wren were talking about a fabulous program they have called “Dads Making A Difference.” This is a training-to-work program for low income custodial and non-custodial fathers. I thought I might do an episode on that program, but then realized that, hopefully, there aren’t a ton of State employees that qualify for it. It’s a great program, though, and I’ve included a link in the show notes.

That led to this general episode on the department of workforce services. So…. what the heck does that agency do anyway??

Let’s start with their mission statement, ‘Collaborating to support a thriving workforce and economy’ – and then their vision is – ‘Leading workforce innovation and investing in employee development today, for a stronger tomorrow.’ So, looking at what they actually do, their mission and vision covers it quite well.

So, as a quick list of the major things they do that help all Wyoming employees and employers…

- They provide career guidance and training

- They provide employee development and help with retention

- They ensure fair employment and workplace safety

- They collect and provide labor market information

- They manage and provide workers’ compensation and unemployment insurance

- And they help individuals with disabilities acquire and retain employment.

To expand on those a bit…

You, or your family and friends, can find career guidance and training at one of the 18 workforce centers around the state. They are a central point of service for those seeking employment, training, and related services. The services are offered to job seekers and employers, and they include:

- Personalized job search expertise;

- Resume and cover letter assistance;

- Job Fairs;

- Career interest testing;

- HireWyo – a website that matches job seekers

and employers; - Prescreening employment applications.

Also, if you get injured on the job, they will show you how to report a workplace injury, apply for medical and indemnity benefits, and get answers to any of your workers’ compensation questions.

They also help employers with all their unemployment insurance and tax questions, and support workers who qualify for unemployment benefits.

They assist people with barriers to employment in obtaining and maintaining employment, and they also provide assistance with accommodations.

Another part of this is something called their Business Enterprise Program which serves eligible Vocational Rehabilitation clients who are interested in becoming self-employed. At the minimum, they help these clients with disabilities with a business plan and funding.

Those are kind of the standard things that, if you know anything about Workforce Services, you know that they do that. There are some other, less obvious things.

They also attempt to make the labor market more efficient by collecting and analyzing labor market information and providing the public, employers and those in power with that information in order for them to make evidence-based, informed decisions. (Whether or not they do…. Is up to them, of course. 🙂

They definitely focus on helping the public and businesses with training. They hold a monthly virtual training series designed to help Wyoming employers, employees, and job seekers succeed. Each one-hour virtual session covers topics like labor laws, workplace culture, customer service, compliance, and career growth. These are free and open to anyone.

They also put on an OSHA roadshow. It’s a two-day workshop that covers workplace safety with expert-led training designed for construction and trades professionals.

And to round out what the heck this agency does, I’ll mention a really cool campaign called Forge Your Future. This is a video library that showcases career opportunities in Wyoming by sharing real success stories in some of Wyoming’s top industries. It spotlights real people stepping into roles in construction, manufacturing, healthcare, hospitality, and tourism. Personally, I appreciate the professionalism of the videos! They are well done. Link, as always, is down below. Check out the YouTube channel.

Ok… now you know. 🙂 This is what a few hundred of your fellow State of Wyoming coworkers are doing. You can find links to all the goodies in the show notes.

As I mentioned at the beginning of the episode, feel free to give me your thoughts on hip replacement. I’ve got a while, as I’m loosely planning on getting it done in October. Seems like I’ll miss out on the least amount of fun things then.

Alright….See ya next time!