The below post is taken from the Video Blog, the Subject Matter Minute. You can view the episode on YouTube if you would like. Find it here: Episode #67 – Submitting a Health Claim on Cigna’s Website

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view it on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello Everybody and welcome to another Subject Matter Minute!

So the last episode was on the Cigna Wyoming on Wellness website that makes it easy to find wellness resources. I hope everyone went out and gave it a look. I decided to give one of the services a go and did a few weeks of therapy through TalkSpace. That’s a service that allows you to get therapy in several ways… Video chat, Live chat and regular chat, where you are just messaging when you have the time. To be honest, the first therapist I was paired with wasn’t responding quickly enough for my taste, so I fired her and was paired with another therapist that is great. It was easy to set up and with our EAP, we get 3 “sessions” for free. This can be 3 video chats, or in my case when you are messaging, you get 3 weeks of chatting back and forth.

So… don’t be scared to get out there and use these services.

I also did an episode recently on the “Ideas Festival.” Well, we seem to have a lot of ideas! At the time of this recording, there have been 225 submissions. And I’ve been told that there are a ton of really good ideas. So… hopefully, these good ideas get implemented and those that submitted them get rewarded! Nice work!

Finally, there has been a big change at the Nagy household, but since I’ve already been rambling on, I’ll save it for next time.

So, typically, when we have health related costs, the provider and our insurance chat and everything gets magically taken care of, right? Well, there are a few reasons why this might not happen, and, thus, we might be required to do the magic ourselves. Today, I’m going to show you how to submit a claim on Cigna’s website. (music)

Before I get started, I want to thank Alice Burron of Cigna for being this month’s episode’s Subject Matter Minute. Thanks Alice.

Like I mentioned, there are a few reasons that we may have to submit our own claims on the Cigna website.

While in-network providers are required to submit our claims, out-of-network providers are not. Some will, but some might not. Another reason we will have to submit ourselves is if we get a blood test beyond the free blood chem test at Wyoming Health Fairs. Also, if you get a Covid vaccine and they don’t submit for you. And finally, if you have emergency care outside the US, you can submit the claim yourself. Also, just so you know… you have 15 months after the expense to submit a claim.

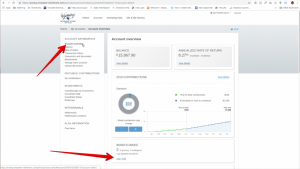

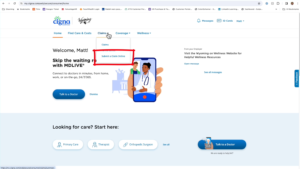

Let’s get to it. So, if you haven’t been there before, you want to start at My.Cigna.com. Either register if it’s your first time or go ahead and login. If it’s your first time in a while, you may need to do the two-step authorization code to your phone thing. Then, you may get an annoying page that asks if you want to invite family members to register. I have just been scrolling down and clicking “skip for now.”

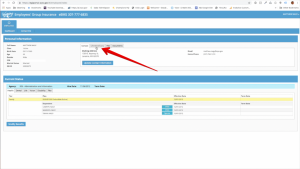

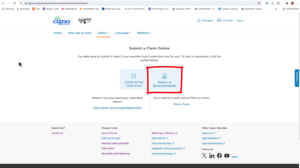

Next, go to “claims” and click on “submit a claim online.” Then you choose the appropriate claim. Mine is a behavioral health claim.

As a side note, you can also submit claims for Covid-19 tests here. You can actually claim up to 8 tests a month. But…. today I’m showing you how to submit a medical or behavioral health claim. So, again, click here.

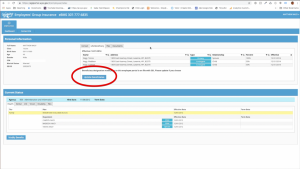

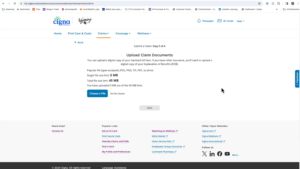

They give you some instructions here. In my case, it’s a claim from an out-of-network provider, so I’m submitting a superbill. You can see the definition of that here. Otherwise, make sure your digital document has these items on it. Then click the “start a claim” button.

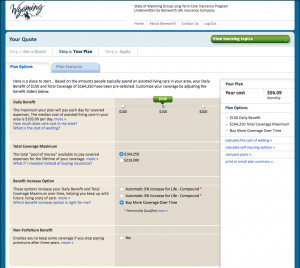

Then you choose the family member that this is for, and click next. There’s a few more steps here. Is this Due to an Auto Accident or Work Related Illness/Injury? I’m going to select “no,” and click next. Is the Patient Covered by Medicare? Again, “no” and next. Does the Patient Have Other Insurance/Coverage for this Claim? One more “no” and next.

If you have different answers for some of those steps, like “if it was an accident” or “covered by medicare,” you will need to have further information. However, you will still end up at the same place where you will upload your claim.

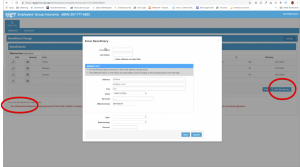

So, click on “choose a file.” Select the file from your computer, and click open. You will see the filename right here. Then click “upload file.” You can add multiple files here as long as all of the steps were answered the same. When you are done uploading the files, click next.

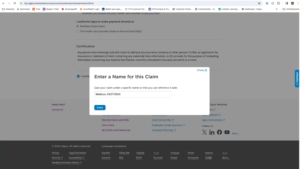

Select who you want the payment to go to. Click the checkbox. Enter a name for the claim. I just leave the person’s name and date as they make it. Then click done. Success! You can read the little “what happens next” text, and you can see that a confirmation message has been sent to you.

So that is the process of uploading claims to Cigna. I’ve done dozens of them and have not had any problems.

If at any point you need help, you can click on this contact us link right here, scroll down, and choose from phone, chat or email. I have made several calls to ask questions about other things, and they have always been very helpful and polite. So don’t hesitate to call.

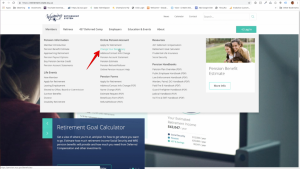

Alright, that’s it for today! I hope everyone is dealing with the spring weather ups and downs well. And if you need some emotional help to get through it, as soon as you are finished submitting your claim, scroll to the top of the page and click on “mental health support” under the wellness menu item, and set up some time with a therapist. You won’t regret it.