The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #9 – Retirement Goal Calculator.

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive.

You can also listen to an audio version: Episode #9: Retirement Goal Calculator.

Welcome to another episode of the subject matter minute. I’m Matt Nagy, thanks for joining me.

Sometimes here I say “hello fellow state of Wyoming employees,” but I

got to admit, I’m feeling a little bit lonely right now. Last episode, I asked

you guys to post your favorite hair band, or a hair band concert from the 80s down below, and I got exactly zero responses. So it could be a couple things here…either I am the only gen Xer out of the 900 or so of you that watched the video, or perhaps you’re embarrassed to admit that you liked hair bands back then? I know there’s a lot of people that make fun of that era but you know music is what it is… If it makes you feel good you like it, and it made me feel good. I loved it!

So you can go back to that episode and comment if you want to or,

you know, no pressure… you don’t have to do that at all, but I’m hoping I’m not the only gen Xer out there!

Before I go on I want to thank last month’s subject matter expert, which again was EGI. Thanks guys for getting me the information.

Today’s subject is actually a tool. I’m going to show you the retirement goal calculator!

The retirement goal calculator. This is a sweet tool put out by the Wyoming retirement system just a month or two ago that can help you decide if you have enough money saved for retirement. Obviously, this month’s subject matter expert is the Wyoming Retirement System. Specifically Polly Scott. She was the one who pointed me in the right direction for this and thought that this would be a great thing to show you guys first. And, she answered some of my questions, so thanks Polly for helping me out!

I’m gonna take you there, show you how to do it, and run you through a couple scenarios. The nice thing about this thing is that it’s simple and that you don’t have to go find your taxes and financial information and input all this stuff. It does some figuring for you and it keeps it simple.

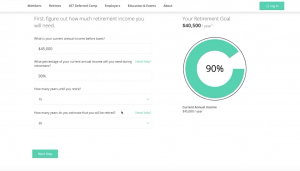

Here’s the retirement goal calculator. You find it by going to this URL: http://retirement.state.wy.us/en/DC/Goal-Calculator Once you get there scroll on down. It’s really quite straightforward. I’m gonna throw in some numbers just to show you how it works.

Let’s just say my current annual income before taxes is $45,000. That’s your annual income. I’m pretty sure that I’m gonna need 90% of that in retirement. How many years until you retire? Basically it’s about 15 years in reality so let’s put that in. How many years do you estimate that you’ll be retired? Well, considering that I have a 99 year old grandpa who is still building houses at this point I’m gonna say at least thirty. Thirty is the max in this calculator. Once you fill those in you can see your retirement goal is $40,500, which is ninety percent of $45,000.

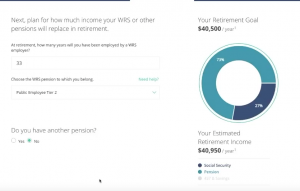

Let’s go to the next step. This is social security. This is kind of an estimate, but as you can see here, it gives you some numbers. Mine’s between twenty and fifty thousand, so let’s just say that maybe you know my income will go up a little bit and by then I’ll have fifty thousand a year… let’s say twenty five percent. Now you can see once you do that it fills in a little bit of this graph over here. So right now you’re getting $11,250 a year. You haven’t quite made it there.

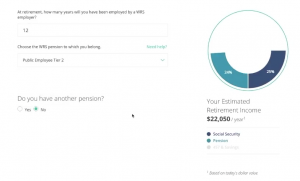

Now let’s go to the next step. At retirement, how many years will you have been employed? Basically, I will have been employed 33 years if I stick it out with the state. This is the one thing you do need to know… which tier you are in. I’m a Tier two employee because I came in late.

Oh my! Based on my inputs, I should exceed my desired income! You can see it right here… my retirement goal was $40,500, and my estimated retirement income will be $40,950. That’s basically because of the years of service.

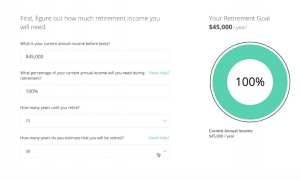

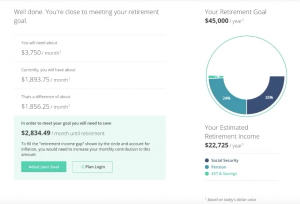

Now I’m gonna adjust my goal. This time let’s do a scenario where I am not saving enough money and will need to save more. Let’s do $45,000 here. Let’s say that I want a hundred percent of my income. I’m going to still say fifteen years till I retire and I’m still going to want that to last thirty years.

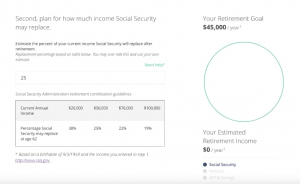

Let’s go to the next step. Let’s do the same thing here… 25 percent.

Next step. Let’s just say that I’ll only have been employed for twelve years, and that I’m still a tier two employee.

Next step. Now there’s another step that wasn’t there when I was saving enough money. Now they want to know how much you’ve saved in retirement on the side. I’m gonna say $10,000 in an IRA or something like that. You know the rate of return is usually like 7% to 8%, let’s just say 6% to be safe.

Next step. Okay, I have not saved enough money by any means! You can see that I’m about halfway there. When I retire I’m only gonna be making $22,000 every year and it gives you a number that you’ll need to save every month until retirement. Hopefully yours isn’t nearly as shocking as that number!

So run some scenarios, change up how many years you work for the state or how much retirement you have saved on the side, or whatever… just run some numbers and see where you’re at. Hopefully this will help you out.

I hope you found the retirement goal calculator useful. Hopefully when you put your numbers in there you were really close to having what you need or maybe even over, and if not, you know you can talk to the retirement folks about the deferred compensation, or find some other way to invest the money.

Thanks again to Polly Scott of the Wyoming retirement system! I want to thank her for getting me the information, and for putting together the

calculator, and I’m sure we’ll be talking to her a lot more down the road about more stuff! That’s it for this subject matter minute, have a great day and we’ll see you next time!