The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #27 – Assigning Beneficiaries

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello, and welcome to yet again, another episode of your favorite video blog…… the subject matter minute. If you got here by accident, I’m sorry. 🙂

So, this video is coming out a little late. I just got back from Japan. Yeah, really! My sister is a Navy Nurse and has been stationed there for the usual 2 years. We decided we’d better take our one chance to see Japan while we still have a place to stay and an awesome tour guide. We had a great time! We ate a lot of fabulous food, did some touristy crafty things, stayed at a military “resort” for a couple days, and put in some good beach/ocean time. I even got to experience something new on the way home. We actually flew out of LA because it cost so much to go out of Denver, and on the way back stayed in Las Vegas. Well, we got to experience our first earthquake! It was weird, exciting and kinda fun. Luckily is was small there. Although it did make the lights sway and then afterwards gave us some vertigo.

Before I get started on this months subject, I want to thank last episode’s subject matter experts… Jared Hanson and Brenda Kelly of HRD. The subject was using the PMI software between phases, if you missed it. So go back and catch that episode. And, thanks Brenda and Jared!

The Subject matter experts for this episode are Polly Scott of the Wyoming Retirement System and Pam Unruh of Employees Group Insurance. I also want to thank Mitzi, one of our fabulous HR coordinators out in the state for the topic suggestion!

Today I want to talk about the importance of assigning a beneficiary.

There are potentially 4 things that state of wyoming employees must choose a beneficiary for… They are Life Insurance through Employees Group Insurance… and your pension, the 457 plan, and Prudential life insurance through the Wyoming Retirement System. These each need different beneficiary designations. They don’t have to be different people…. They just each need to be assigned separately.

You are automatically enrolled in your pension, and the 457 plan. The state pays for the life insurance that you can get through EGI, but you have to elect it. (so definitely do that… it’s free) And finally, the Prudential Life insurance through the WRS is also a voluntary program. So, you pay for it and don’t have to sign up for it.

So…. what happens if you don’t select a beneficiary for these things??

When electing life insurance or changing your beneficiary through EGI, you can use paper or the online portal. When using the portal, if you elect life insurance, the system will require that you add a beneficiary. If you use paper, it doesn’t…

So…If an employee that has elected life insurance through EGI does not elect a beneficiary or the designated beneficiary is also deceased, benefits will be paid first, to your spouse, then your children, then your parents, then your brothers and sisters, and finally your estate. If it’s going to more than one person… like you have 3 siblings, then the money will be distributed equally among them.

One thing you need to be aware of… if you name a minor as your beneficiary, benefits can’t be paid to them. A guardian would have to be court ordered and the benefit would be payable to the guardian.

Ok, so that seems pretty standard, right? Well, when you name your beneficiary, you put in their name…. Not relationship. So, if you put down your wife or husband and then you get divorced, the money will still go to them. I’m guessing that not a lot of divorced people want their $50,000 life insurance policy going to their ex. Just a guess. Might make a few people roll over in their graves! So keep that in mind!

The issue of people not selecting beneficiaries has grown since we went to online systems and also automatic enrollment. People’s pension accounts and 457 accounts are set up automatically, but they still need to log into their online account for each and add the beneficiary information.

Something to note on the pension, if you elect more than one primary beneficiary on your pension then the beneficiaries won’t have the choice of a lifetime monthly benefit and will have to take a lump sum refund. Consider this carefully, and you can always add contingent beneficiaries who take the place if the primary beneficiary is deceased. If you should die in-service without a beneficiary, benefits would be paid to the estate. There isn’t an order precedence for pension benefits. That is why it is so important to establish beneficiary(ies), because going to the estate could complicate matters, or make things work out differently than you had planned.

The 457 Plan does have an order of precedence, but it is still important to designate a beneficiary because there would be an additional waiting period if the order of precedence is used. So if you don’t have a beneficiary selected, the money would first go to your estate, then your spouse, then a child or children and finally to a parent.

Finally, the Prudential life insurance through WRS has an order of precedence that goes

- surviving spouse

- all surviving children

- all surviving parents

- all surviving siblings

- estate

Ok, I’m going to quickly show you where and how to change your beneficiaries. 3 of them can be done online. It’s simple. Prudential Life Insurance can be changed by calling 800-525-8056 and requesting a form.

First, I’m going to show you how to add or change your beneficiary in the life insurance that we get through EGI. First of all, go to A&I’s website and come up here to divisions. Click on Human Resources or the arrow next to it, then click on group insurance.

Now you’ll be on EGI’s site. Here’s the benefit portal go ahead and click on that. If you’d like there’s a couple videos you can watch: “how to register” and “using the portal for open enrollment changes,” but here is the portal access down at the bottom.

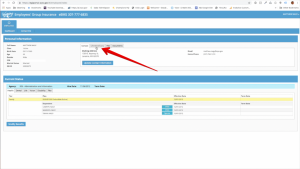

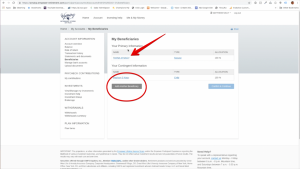

That’ll open up a new window and you’ll have to log in. It gives you more choices typically, but because I logged in with with Google that’s what it’s giving me and that’s kind of a familiar login. It will give you an opportunity to pick your gmail account and then you’d be in. So, as you can see, I’m in. This is the page that shows up. Here is your life insurance beneficiary.

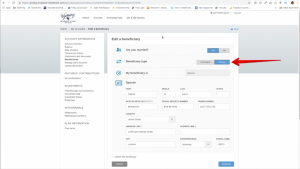

Very simple. You can see I have my wife as the primary and then I have my two kids as contingent; they would be 50% and 50% should it go to them. All you do is click on update beneficiaries, you can see everyone that’s listed.

Here you can edit or you can add. If you edit someone you go in you change the name, blah blah blah, save. I’m gonna cancel out. If you want to add go ahead and add one. You would put primary or contingent, relationship percentage, save it. I’m gonna cancel out of that. After you change something you need to click here, and then save. But I’m not gonna do any of that because I’m already good here.

That’s the employees group insurance life insurance beneficiary add or change.

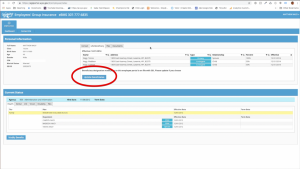

Now I’m gonna show you how to add or change beneficiaries for your pension through the Wyoming Retirement System. First, go to members, and then online pension account, come down to change your beneficiary.

This opens up a new window. You’ll need to login, and it takes you right there. You can see right now I have a primary beneficiary as my wife. I have not added my kids… I think it’s mainly because I could not remember their social security numbers, but all you would do is update the information.

If I wanted to add them as contingent beneficiaries I would create new, add one daughter, and then I would create new and do another one.

But since I’m not adding them today, since I still don’t remember their social security numbers, I will just cancel out of that. Then you click continue when you’re done.

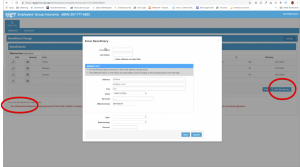

This time we’re going to change our beneficiaries in the 457 deferred comp account. In order to do this, come on over here to login click on that. Click on the 457 plan login. Login to it.

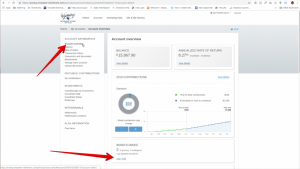

Click on account, and then right over here under account overview is beneficiaries, or down here beneficiaries.

You can go to add/edit down here, and as you can see my wife is my primary beneficiary and one of my daughter’s is a contingent beneficiary. If you wanted to add, you would just add. If you wanted to edit, you could edit.

I’m gonna cancel. If you add, you would choose the type, contingent or primary, and save it. I’m gonna cancel out of that.

That’s all there is to changing or adding your 457 beneficiary.

There might be a few of you out there that just really don’t give a rip where your money goes after you die. After all, your dead. But I’m guessing that most do care. Please get in the systems and add your beneficiaries if you haven’t, and then check them somewhat regularly to make sure they are still good. Especially if you have changes in your family.

Well, it’s not a lot of fun to talk about things that involve our deaths, but we are all gonna go. So get your ducks in a row. 🙂

That’s it for this month’s subject matter minute. Please join me next month for what “might” be a more uplifting topic. Actually, I’m not sure what it’s going to be yet… but we’ll see you then.