The below post is taken from the Video Blog, the Subject Matter Minute. You can view the episode on YouTube if you would like. Find it here: Episode #71 – Flex Reimbursement Process

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view it on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello and welcome to the Subject Matter Minute! Glad you could join me… We are waist deep into what they call the Open Enrollment period, so I hope you have watched all the relevant episodes that go over items you can enroll in and/or change during open enrollment. I covered one of these things in the last episode. That was episode #70, and it covered the Flexible Spending Accounts. If you didn’t watch and aren’t sure what I’m talking about… and you haven’t gone through the open enrollment process yet, be sure to watch it. This episode is also about the Flexible Spending Accounts, but today we will be covering more of the process of submitting documentation. So… today we are covering the Flex Reimbursement Process. (music)

Before I get started, I need to give a shout out to this episode’s Subject Matter Experts… Karyn Williams and Karissa Toalson. Thank you for being patient with me and my dozen or so questions!

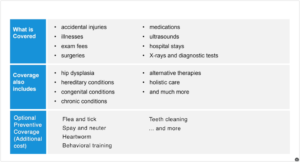

So, you set up your Flexible Spending Accounts and have money coming out of your check pre-tax for out of pocket medical expenses, daycare and even some over the counter supplies. How do you go about actually getting reimbursed? Well, you are obviously going to need some documentation to prove that you had these expenses. So that is what we are talking about today.

There’s a few ways to submit your documentation. You can do it the old-fashioned way and actually print out and hand over and/or mail the documentation. You can also gather your electronic documents and email them, or you can use the portal to submit them. I gather that the portal is the preferred method as far as EGI is concerned, but there is a caveat with that. I’ll elaborate in a bit.

So, what documents are you going to need? First, you will need the reimbursement claim form. This form is linked in the show notes. You will need to fill this out… I will show you how.

Next, for medical reimbursement, you will need supporting documentation, most of which is EOBs or explanation of benefits. You get that from the Cigna or Delta Dental website. Not to worry, once again 🙂 I’ll show you how.

You may also need receipts if it’s something that doesn’t have an EOB (explanation of benefits) associated with it, like vision or if it’s covered over the counter items.

For Daycare, you’ll either need an itemized receipt or you can have a signature of the provider on the claim form. I’ll show you what I’m talking about.

First… I’m going to show you how to gather all your “stuff,” then I’ll show you how to do it the paper way and then I’ll show you how to do it on the online portal. Ok? Alright, let’s go find our EOBs on the cigna website.

Ok… Here we are at the cigna website. Go ahead and login. If you haven’t before, you will need to click on “register.” You may need your insurance card to register.

Once you are logged in, go to the top menu bar and hover over Claims, and then click on claims. You can see that this is showing only my claims right now. If you have a family and want to see all of the claims, you can click “view all” here.

Side note… please don’t freak out that I’m showing this information. I really don’t care if you know who our doctors are. 🙂

So… I’m viewing all at this point. The other thing that you may need to change is the year you are viewing. If you are doing this during the year you are submitting for, you want to select “year-to-date.” But, if you are doing this in February for the previous year, you will want to select “prior year.”

Now you can see all of the claims for the year. And yes, there are a lot of them. You want to look for the ones where you owe money. Alright? It’s pretty clear. Depending on how much you elected for your medical reimbursement, I find that things are much easier if you use the biggest charges. For instance… If I only had $1500 in my flex account, I can do it all with just one EOB… this one right here for over $1600.

But no matter how you do it, this is how you get your EOBs. Find one where you owe and click on “download EOB.” That will open the EOB in a new window and/or tab. From here, you can either download it or print it… depending on how you are submitting your documents. In my browser, the buttons for this are in the upper right corner. Yours may differ slightly.

Now I’ll show you how to do the same on the Delta Dental Website. Go to deltadentalwy.org and click login. (link is in the show notes) Select subscriber, then login, and then click on claims. Take a look down the “patient pays” column for the services you paid for, and then click “view” in the EOB column. The EOB will open in a new window or tab. The printing and downloading are the same as they were for Cigna.

Now that you have all of your EOBs gathered up, let’s go over how to fill out the reimbursement claim form.

Here is the flexible spending reimbursement claim form. As it says at the top, this is for medical, daycare and over the counter reimbursement.

Top part is pretty straightforward. Fill it out.

The next section is the Medical section. This is where you list all of your EOBs and/or your receipts for medical items. As it says in red, you need to list each service date separately. For you long-timers, this is a bit different. You used to be able to group services from one provider. No longer… Please list them separately. Then fill out the rest of the information, put the amounts and the total.

This is a good spot to pass on something I’ve learned over the years. When filling out the medical reimbursement section, you can avoid that letter you get when the total is more than you elected with your flex account with a simple trick. This letter. (show letter) As long as your total is over the amount you elected for flex, you can just put the “correct” amount as the total. So… for instance… All the providers add up to $1540, but you only elected $1500 for your medical flex. Put the providers in the appropriate way and then put $1500 as both totals. EGI will reimburse the $1500 and you won’t get the letter. Tricky, right?

The next section is the daycare reimbursement area. This is slightly different. For one thing, if you remember from the last episode, you can’t claim money that hasn’t yet been deposited or contributed to your flex account. Also, you need to get the tax ID number or social of the provider and put it with the name of the provider. Then go through and put the date of service, the dependents name and the rest. Same deal… put the amount and the total.

Remember that with daycare reimbursement, you can’t request more reimbursement than is in your daycare flex account. If you do, you will receive a letter that looks like this. (show letter) However, the system will track the claim and reimburse you for that extra as funds come into the account.

Ok… next is the new “over-the-counter” claims section. You can claim certain over the counter medications, but not all, so it’s best to do a little reading in the Flex booklet that’s linked in the show notes. So you fill that out just like the other sections.

Make sure to read the information below that section. It’s important information. Also, before you sign, you should read all the info below the signature line. That’s just good practice when signing your name, right??

Next sign and date here if you have already printed it out and if not, print it and sign and date.

The next step is submitting all of this stuff on the online portal. (or dropping it off to EGI, or sending it to EGI) But, before we go there, I want to warn you that they want all of the documents combined into one document for upload. Also, if you can put the supporting documentation in the order of your claim form, it’s a big help to EGI when processing. If you have a year’s worth of EOBs and they do not match up to your claim form, your claim may be returned to you.

There may be a bunch of you out there that know how to combine and order files in Adobe Acrobat, and that’s great. Just do it.

(VO) For those that don’t have access to Acrobat, or know how to use it, there is a free online tool that can make it happen.

It’s called Merge PDF Files and it’s also by Adobe. Unfortunately, you do have to create a free account to use it, but it’s pretty straightforward. The address is https://www.adobe.com/acrobat/online/merge-pdf.html. The link is in the show notes. Just drop all the EOBs, scanned receipts and the claim form into it, reorder the files, merge the files and download the merged file.

Another option that I’ve heard of is to put the papers in order and xerox to your email on a copier.

In any case, once you have all your files merged, you can go to the portal to do the uploading.

Go to the portal by using your bookmark…. Or by going to the A&I website, then clicking on Employees’ Group Insurance, then scrolling down and clicking on the portal link. On that page you will find helpful videos showing you how to register and how to use the portal during open enrollment. For now, just click on “employee portal access.” Click on “log in.” Then sign in however you have in the past. I use Google personally.

You don’t have to go far to make this happen. In the top section, you will see a tab called “Flex.” Click on that tab. Next, you will click on the “upload flex claims” button. You can refresh your memory about the details by reading the information on this page and when you are ready, click “new upload.” Next, click “select file.” Click “choose file,” select your file, and then click “attach file.” I can’t show you, but don’t forget to click “submit” after attaching, as sometimes folks do and the claim is not actually submitted. I’m not going to be doing that right now. So, I’m going to cancel.

You should see your file in the documents tab, but you might need to “show more items” and scroll down. Once EGI audits the claim, you will see it in this list under the flex tab.

Ok!! I know that’s a lot, but it is what it is. 🙂 Get in there and get reimbursed! I gotta fly… see ya next time.