The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #29 -PMI Midyear Coaching Phase

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello and welcome to another episode of the subject matter minute! Thanks for joining me.

So, last episode I sent out a plea to a couple state employees whom I thought were pretty big fans of the show, but I’ve heard nothing! You ladies are breaking my heart. If I ran into you at the Norah Jones concert, please contact me via email, as I would really (still) like a copy of the photo we took.

I want to tell you guys a little about a trip my wife, a group of friends and I took just a couple weeks ago. First of all, it was the hardest thing Tanna, my wife, and I have ever done. Secondly, it was the most beautiful mountain range we have ever experienced. Eleven of us did a supported mountain bike ride from Telluride to Durango, in the San Juan mountains. It ends up being about 80 miles of riding, and at one point we peaked out at 12,600 foot elevation. Leading up to it, we were like… well, 20-25 miles a day doesn’t seem too bad. We have all day to do it. And we aren’t racing, so it should be cool. Well, those miles took a while. Every day was at least 6 hours of intense, technical riding. I’m not complaining… we felt so accomplished and satisfied each day as we sipped on our ice cold beer. That was the other thing… like I said, the trip was supported. So a guy we paid set up a kitchen and a groover and hauled all our coolers and camping gear to the next spot. We camped 3 nights and rode 4 days. We had perfect weather, the wildflowers were like nothing we have ever seen and for the next week at least, I was in the best shape of my life. That was one for the books.

Ok… now let’s get to something I know you are all pumped about… PMI. For you newbies, this means Performance Management Instrument. A few episodes ago I went over some of the technical stuff. The tools you can use to maximize the effectiveness of the system and possibly help your ratings. This time I want to be timely with the show and hit the current phase…

This episode is about the Midyear Coaching Phase. (music)

Before I get started on the midyear coaching phase, I want to thank this episode’s subject matter expert, Brenda Kelly-Mitchell. She is the master of all things PMI and works her butt off making the system work. Thanks Brenda for getting me the information.

As you should know, there are 3 phases to our PMI. This is the middle phase when managers and employees get together and talk about progress, problems, goals, expectations, and all that. This is a formal and documented get together. Now by formal, I don’t mean it can’t be relaxed, and honestly “informal.” It just means that this meeting is required.

While coaching itself is often perceived as the manager’s responsibility, it is a two-way street – and definitely a time to make sure that we, the employees, are informing our managers of successes, any obstacles that are keeping us from getting stuff done, or maybe resources needed that could overcome those obstacles. Let’s be honest, if your manager doesn’t know what is holding you back, they make assumptions. So this is a great time to let them know.

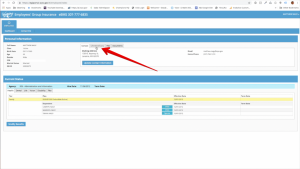

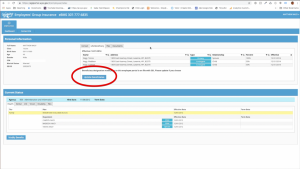

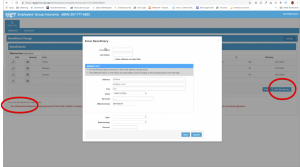

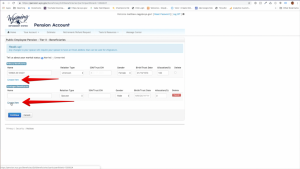

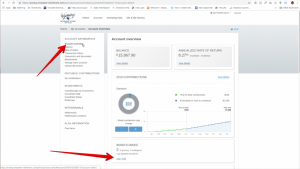

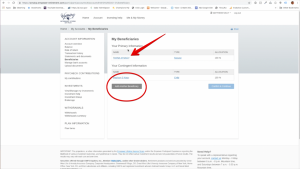

Naturally, you would be putting those things into the Talentspace software, right? Like I showed you 3 episodes ago? But…. that doesn’t guarantee that your supervisor is even paying attention. So… again… bring it up in the Mid-Year meeting.

Also, we all know that priorities shift from season to season, month to month, and often day to day – so, this is a great time to talk them over and recalibrate if needed.

Midyear is also a time that we reconnect on topics such as Career and Development – like learning new skills and gauging interest in new experiences. So, if you have been eyeing an online course, a conference, or even considering expanding your role in your agency, this is a good time to bring it up.

As a manager, take advantage of this phase to give praise where it is warranted. If goals are being met and everything is progressing as expected, be sure to bring that up!

And finally, this is also a time to try to redirect performance and/or behavior that isn’t inline with the goals and target ranges set up in the planning phase, or with the state in general. This is a nice way of saying that poor behavior should be addressed.

Let’s get into some formalities. Each phase has the “same” 6 steps that need to happen.

- Evaluator Writes midyear comments on goals and core competencies

- Second-level manager reviews and approves

- HR Reviews and approves

- Manager meets with employee (conducts the interview)

- Employee reviews, comments, acknowledges receipt

- Evaluator signs off

Ok! I’ve included links to some materials that can help with this process in the show notes below this video. Please check them out.

Trust me, I know it’s sometimes hard to make time for the PMI process. But…. it’s something we all have to do and we might as well do it well and do it right. Who knows, maybe 10 years down the road there will be some raises tied to it. 🙂

That’s it for this month’s SMM. Check in next month when I do an episode that could make you some money!

Grievances are a dispute between you, the employee, and management. The dispute is about a statute, a rule, an executive order, or a policy concerning personnel practices or working conditions. I know that is a bit of a mouthful, but it’s important because there’s a lot of things you can’t grieve. So grievances specifically are about, again, a statute, a rule, an executive order, or a policy concerning personnel practices or working conditions. These are the things you can grieve.

Grievances are a dispute between you, the employee, and management. The dispute is about a statute, a rule, an executive order, or a policy concerning personnel practices or working conditions. I know that is a bit of a mouthful, but it’s important because there’s a lot of things you can’t grieve. So grievances specifically are about, again, a statute, a rule, an executive order, or a policy concerning personnel practices or working conditions. These are the things you can grieve.