The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #20 – The Public Employee Pension Plan, Part 1

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello and welcome to the Subject Matter Minute, I’m Matt Nagy, thanks for joining me.

Today I am gonna cut right to the chase, because we have a lot of information to cover. I’m not gonna talk about my mullet or my teenagers, I’m just gonna get right to it. Today I want to talk about your retirement, or the public employee pension plan.

The public employee pension plan… I hope I didn’t pop that too much in your ears… or otherwise known as your retirement with the state. First of all, it’s the largest pension plan administered by Wyoming Retirement System. They also administer seven others for other types of employees. You can see them here on this list.

Today we’re going to talk about the one that covers most of us. In case you didn’t know, the pension plan is the mandatory retirement that you get with the state. There’s a ton of great information on the Wyoming Retirement System website. I have some links down below, be sure to click through them. You’ll get some more information in addition to what we talk about today.

The beautiful thing about our pension plan is that you can’t outlive your benefits. We’re putting in a portion of our income monthly, but even when that runs out you will still get a monthly payment for the rest of your life. There’s another name for it… it’s called a defined benefit plan, and that’s because it’s based on a formula and not the contributions. The formula is based on your age, service credits, or years of service, and highest average salary.

A lot of people tend to focus on the amount in the account, and that’s kind of natural because, with the 457k or just a investment account, an IRA, that’s the money that you’re gonna be using for retirement, but in the case of a pension, the only reason you would need to focus on that is if you leave the state and cash out your account or if you die before retirement.

Should you die before retirement, your beneficiary is entitled to either your pension as you would have gotten it, or a lump sum, so it’s very important that you keep your beneficiary information up to date.

There are over 450 employers in the state who use this same plan, so if you were to leave the state and work for another one of those employers, your pension travels with you… you can just continue on.

Things are a bit different for UW and Community College employees. When they first become employees they need to choose between two retirement entities… the Wyoming Retirement System or TIAA. Once they make that choice, they have to stick with it forever, or at least until they terminate employment.

Otherwise, getting this ball rolling is easy. Your employer signs you up and sets up the monthly contributions.

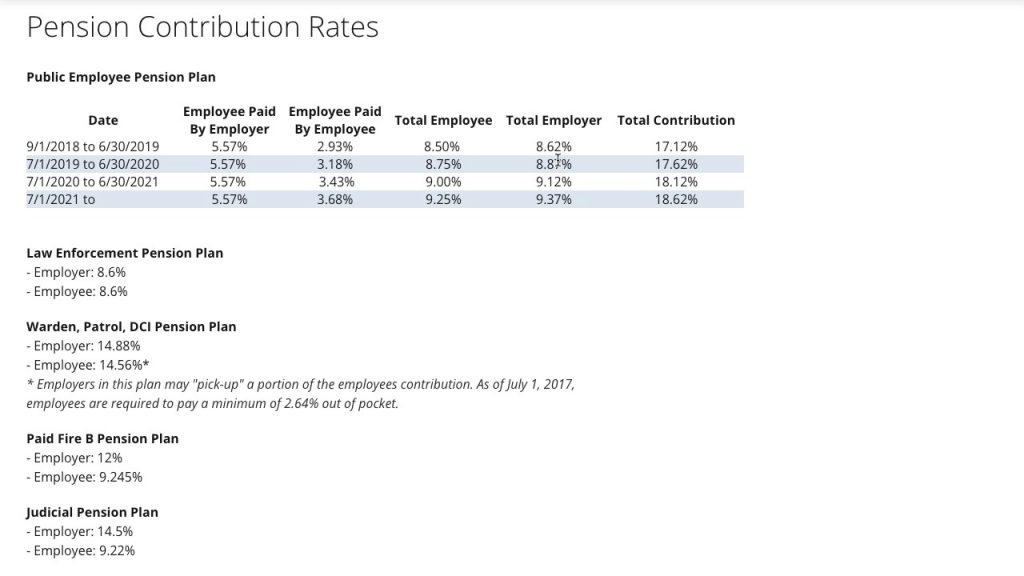

The contributions you do as an employee contribute to the pension as does the state. Basically the state and the employee pay a percentage of the employee’s income. Right now, this year, the total employee percentage is 8.5 percent and the total employer is 8.62. However, I’m not sure why they even list it like this because in our case the employer actually pays 5.75 percent of our percentage. So really you’re paying 2.93 percent of your salary towards the pension.

You can see they’ve got it scheduled to go up, but even by 2021 it’s only going to be 3.68 percent that we are contributing. The state is covering the rest… so not bad, not bad at all.

You qualify for a lifetime benefit once you’re vested and reach retirement age. You need 48 service credits to be vested. Usually this means 48 months. It’s different depending on how many hours a month you work. Most state employees are full-time and are gonna get a month of service for every month they work. If you’re a part-time or seasonal it’s different. If you work 86 or more hours in a month you receive one month of service credit. If you work 40 to 85 hours you get a half service credit, and if you work 1 to 39 hours in a month you get a quarter service credit. So that’s how you figure that out. Once you get 48 service credits, you are vested, which means that even if you quit state employment, you can eventually get your pension benefits when you retire… when you reach that age.

When can you retire and start collecting? Currently there’s two different scenarios… it depends on when you are hired. Currently we have two tiers… they call them tiers… if you were hired before September 1st 2012 you are in tier one. If you were hired on or after September 1st 2012 you’re in tier two. Tier one folks get to retire at age sixty and tier two folks have to wait until they’re 65, or both of them, in either tier, can retire if you reach the rule of 85.

So I got hosed… I feel like I got hosed… I literally became an employee two months after the change to tier 2. Tier 1 folks get to retire at age 60 and they have a higher multiplier percentage… you’ll see what I mean in a minute, than tier two. Us poor folks in tier 2 have to wait until 65, and it’s less a percentage of our max income. Anyways, I missed it by 2 months… yeah.

You’ve probably heard of the rule of eighty five. Under the rule of eighty-five, you qualify for retirement benefits if your years of service and your age equal eighty-five or more. Stop doing math… do that after the show, okay? Keep watching. 🙂

So how much money can you expect to receive when you retire? Well, simply put, the equation is this. You have a multiplier (like I mentioned it’s different for tier 1 and tier 2) times the years of service, times your average monthly salary.

(multiplier) X (years of service) X (highest average salary)

So let’s do a quickie here, just do some quick math. Let’s say your top salary is $4,000 a month, you’ve worked for the state for 20 years, and your tier two. I’m gonna do tier two because it’s a little more simple. So that’s

$4000 X 20 X 0.02 = $1600

Tier two multiplier is 2%. So that means that if that’s my highest average salary when I retire, I’m gonna be making $1600 a month. Not too shabby.

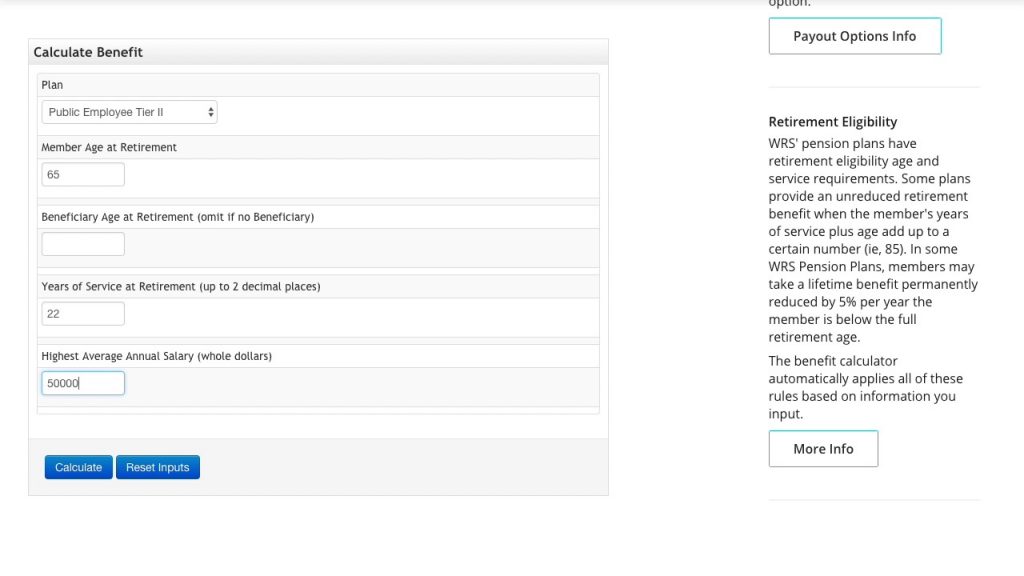

Or you can go to the WRS site and they have a calculator on there. Here you can play around with the numbers. You can change your age at retirement, your years of service, your highest average salary, and kind of play around with the numbers to see what would work best for you.

You can also log in and do an estimate within that area, but the problem with that is that it says that your highest average salary is your current salary. At at the current rate of raises at the state, that might be the case, especially if you’re getting close, but hopefully at least us that can’t retire for a while… hopefully our highest average salary will be more than that?

So the best scenario is to use that calculator that we just showed you.

What are your options when you leave employment with the state? So you can keep your pension… you can leave it with the state, or you can take a lump sum… you can cash out. If you leave it with the state, you will have the same same scenario when you retire… you will get a lifetime benefit… if you’re vested. There’s a lot of things to consider when you’re doing this. WRS has a whole bunch of information on this. Here is a brochure that talks about the questions you should ask yourself. Check that out if you’re getting close, and you’re trying to decide what to do.

If you want to leave your job and take a refund you would get your contributions plus interest… not the state’s contributions.

You also have some time to think about it. You do not have to make this decision right away, so take your time, read up on the choices, and make a good decision.

Like I mentioned, there are a ton of employers out there who also use this pension plan, so if you move to one of them, or leave the state and come back to the state, and did not cash out your pension, then it will continue on where you left off.

I think that’s enough for today! That’s a lot of information. Like I mentioned, we’re gonna have a round two with more information so be sure to tune in next month.

Today I covered what a pension is, how much comes out of your check, when you become vested, how you accumulate service credits, when you can when you can retire, how much you can expect to get via the formula, and what you can do if you leave employment.

Stay tuned next month for information on what happens if you die before you retire, beneficiaries, applying for retirement, retirement payments, and more. That’ll do it for the Subject Matter Minute this month, thanks for joining me and I’ll see you next time.