The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #33 -COBRA

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello ya’ll! Thanks for joining me for another fabulous episode of the subject matter minute. I really do appreciate how many of you guys actually watch the show. It amazes me every month. So, thanks a ton! I also appreciate getting feedback and answers to my questions! I asked for input on my future Alaska cruise and I got a bunch. Really useful stuff. From small things that you wouldn’t think of… like putting some sort of decoration on your cabin door (so you can find it), to bigger decisions… like not booking excursions through the cruise line… possibly fetching you a much better deal onshore and a less crowded adventure. Thanks for all the advice, and now I’m really looking forward to the trip!

Alright, so today let’s talk about something we’ve all heard about, (we’ve seen the word) but most of us really don’t know what it means. Today let’s talk about COBRA. (music)

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act of 1985. A mouthful, eh?

Before I get started, I would like to thank this month’s subject matter expert, Kathy Simpson of EGI. This topic is considerably more confusing than I thought it would be, and Kathy patiently took my barrage of questions and guided me to COBRA enlightenment. Thanks Kathy.

Ok, so the basic idea behind COBRA is to allow workers and their dependents to maintain their health coverage after an event such as job loss, divorce, or death.

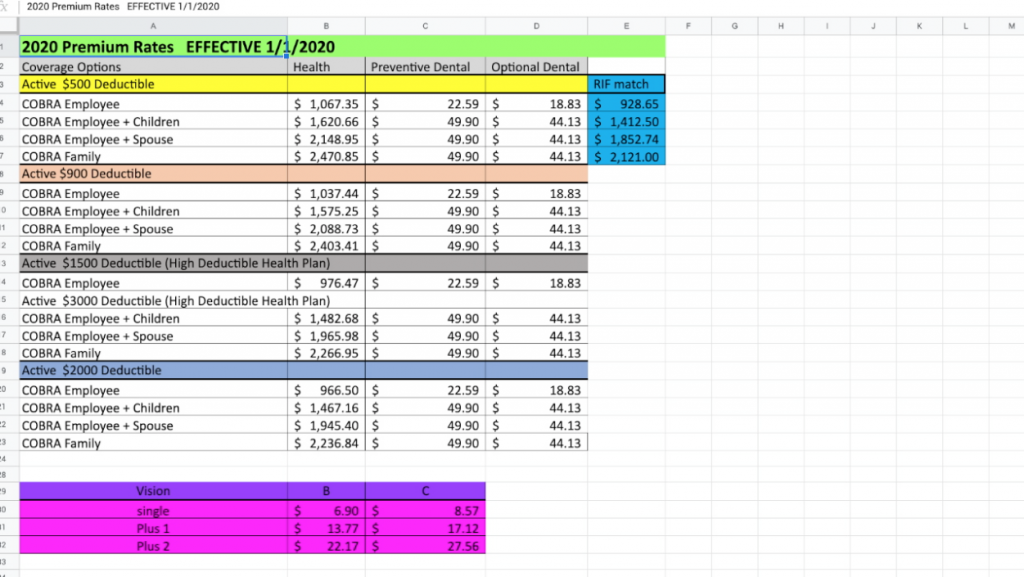

Before I get into the details of eligibility and such, let’s talk about the elephant in the room with COBRA. First of all, Health insurance is crazy. And by crazy, I mean crazy expensive. We have it so good at the state. The bottom line with COBRA is that the state no longer kicks in anything. You have to cover the total cost. Not sure if you guys have ever paid attention to that number, but it’s big. So, let’s look at how much COBRA costs. Here’s a fancy little graph. I currently have family coverage with a $500 deductible. That means that the total cost is $2422… but the state kicks in $2121, which means I pay basically $300/month. If I were to go on COBRA, I would be paying the whole thing at $2470/month. That total is what I would have paid without a match, plus a 2% administration fee. Now that would be a shock to the system. Same with a $900 deductible. Not much difference there. So… my point here is that it’s expensive.

However, since I’ve been warm and cozy in my little state employment cocoon, I don’t have any idea what private health insurance costs these days. It may cost the same for all I know. But you obviously would have to compare.

There is an exception here, and that is if you get Riffed. You can see that the state still kicks in a large portion in that scenario.

Ok, let’s get back to the details of COBRA.

First of all, as a COBRA Participant, you can only select a plan with the same or lower cost than the plan you had as an active employee or under active coverage. You may not select coverage (e.g. vision) that you did not have as an active participant. You only need to enroll in the benefits you need. For instance, if you only need dental, and you had it before, you can elect only dental. However, you do not have to elect dental if enrolling in a health plan with COBRA.

COBRA applies to most employers with 20 or more employees, with a few notable exceptions such as health plans sponsored by the federal government, and church-based employers. But COBRA does apply to the state.

In order to be eligible for COBRA, you must meet 3 requirements:

- The plan must be covered by COBRA.

- A qualifying event must take place — this includes a job loss (other than for gross misconduct), reduction of working hours, divorce or legal separation, death of the worker, or a worker’s child losing their dependent status under the plan.

- The individual must be a qualifying beneficiary, which basically means that they were covered by the employer’s plan the day before the qualifying event took place.

So, you can’t have COBRA forever. It’s time limited. The maximum coverage period depends on the type of qualifying event and certain special circumstances. If the qualifying event is the termination of the employee (other than for gross misconduct) or a reduction in hours, the maximum coverage period is 18 months. There are a few exceptions to this, dealing with medicare, disability and such… However, after going back and forth with Kathy, I’ve come to the realization that it can be a bit confusing… so I’ve decided to take the easy way out. Please take your confusing scenario to EGI and let them explain the details. I mean, you need to talk to them anyways…

Ok, so the bottom line, as I said before, is that for termination or reduction of hours… aside from the few exceptions, you are allowed 18 months of COBRA. For all other qualifying events, the maximum coverage period is up to 36 months. These qualifying events include:

- Employee enrollment in Medicare (spouse and dependents get 36 months COBRA)

- Divorce or legal separation (spouse and dependents get 36 months COBRA)

- Death of the employee (spouse and dependents get 36 months COBRA)

- And Loss of “dependent child” status under the plan. (when a kid turns 26 they can get 36 months of COBRA

There are some reasons that a plan administrator could terminate COBRA coverage before the time period is up. The main reasons are:

- Failure to pay premiums due

- The employer ceases to offer a group health plan

- The COBRA beneficiary becomes entitled to Medicare

Ok… some timelines here… Within 14 days of EGI becoming aware of your qualifying event, you’ll be sent an election notice. Since the State must notify EGI within 30 days of most qualifying events, within a month and a half of losing your job or some other qualifying event taking place, you should receive a detailed COBRA Packet to help you decide if you are going to continue your health coverage through COBRA. This packet has the enrollment form and all information related to COBRA.

Under federal law, you have 60 days after the date of the notice or the last day of coverage, whichever is later, to decide whether you want to elect COBRA. You do not have to send any payment with the Election Form; however coverage will not be activated until full payment is received. Payment in full is due within 45 days of your election. There cannot be a lapse in coverage.

And, it’s important to mention that every person covered under your group health benefits can make their own election to sign up.

Finally, cancellation of COBRA must be received in writing to EGI, and once COBRA is canceled there is no opportunity for reinstatement.

Continuing your health coverage through COBRA can be rather expensive, so it may be worth looking into these other options first:

- Buying coverage through the marketplace at www.healthcare.gov

- Checking your eligibility for Medicaid

- Obtaining coverage through your spouse’s employer (a qualifying event for COBRA also entitles you to a special enrollment period for other group health plans)

Ok!! I hope I didn’t just make this more confusing for everyone! I mean, you are going to have to talk to EGI anyways, because this is an important decision, right? The bottom line is that COBRA is a short term coverage option for employees and dependents when the employee has one of the previously mentioned “qualifying events” occur to them.

That’s it for today, thanks for joining me on the Subject Matter Minute. I’ll see ya next time.