The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #41 – Statewide EAP

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello, and welcome to the show! Thanks for watching.

One thing you learn quickly when you start working at the state is that there are a whole bunch of acronyms that people throw around. I still regularly ask…. Um, what does that stand for?? Well, today we are going to talk about one of those acronyms… the EAP.

But first…. Remember back in the day when I asked for your input on what to do and how to do an Alaskan cruise? Well, those were the good old’ days before COVID, and that trip got canceled. Like so many others… But, my mom was determined to get us all together to do something. So, a couple of weeks ago we went on a horse pack trip in the Wind River Mountains. This wasn’t our first trip… in fact, it was really the 10 year anniversary of our previous trip with my parents and my two girls.

So, this is how we did it. You bring a big pile of gear, food, and drinks to the Diamond 4 Ranch, which is about an hour and a half drive straight up into the Winds from Lander. Gotta tell you, my Highlander didn’t really like that road. Anyway… they take that pile and pack it all onto the back of horses and then you ride about 8-10 miles into the backcountry. They drop you and all your gear off and they leave. Then 5 days later, they come back in to see who has survived.

Oh, did I mention that there are bears in the Winds? Well, we didn’t see any.

Even though I haven’t done it in a long time, I used to backpack, and I’ve got to say that I really preferred having my cot in the backcountry.

I’m not much of a horse guy. Sorry, I’m sure a lot of you are… But, I’m allergic to them and my legs don’t bend that way. So, I hiked in. The rest of the family rode and had a decent time, but I really enjoyed the hike.

The weather and scenery were amazing, and we were still able to have a campfire, so the trip was awesome. If any of you happen to have a big pile of money lying around, you should give it a go. My parents were very generous and used their pile for us… so that was nice.

Ok. Hopefully, if you don’t want to hear my gibberish, you know how to skip it by now. All you have to do is go to the show notes and click on the time that I provide. Or you can click within the playbar of the video. (show how while saying this)

The last episode was some good news and so is this one. Last month we talked about our new access to LinkedIn Learning training. This month we are going to talk about our new Employee Assistance Plan. (music)

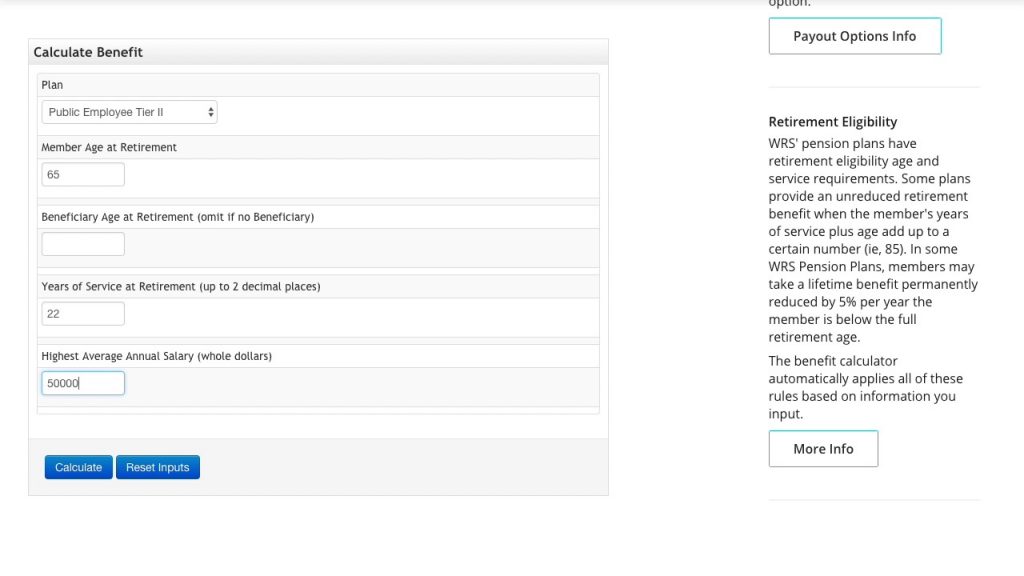

An employee assistance program (EAP) is a work-based intervention program designed to assist employees in resolving personal problems that may be adversely affecting the employee’s performance. EAPs traditionally have helped workers with issues like alcohol or substance abuse. However, most now cover a broad range of issues such as child or elder care, relationship challenges, financial or legal problems, wellness matters, and traumatic events like workplace violence. And luckily for us, ours covers all those things. The company is called FEI Behavioral Health and they have 4 categories of direct help for us. They are Counseling services, Work-Life services, Legal Services, and Financial Services. There is a wide range of topics contained within each of these categories. The website also contains a ton of information that you can read, watch, and listen to. But, let’s just go to the site, so I can show you….

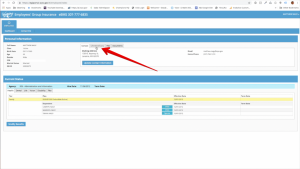

The website is https://www.feieap.com/. You will see this login page when you get there. The login for the State of Wyoming is “sowy1”. Now you are in the State of Wyoming area.

First of all, if you need help with any of those areas that I mentioned, in any way, you can simply call this phone number. (888-218-7360) Really, in the end, you’re either going to call this phone number or you’re going to use the contact request form right here. That’s the basics of what you need to know.

Let’s check out their website. Down here it has a list of our services. Benefits overview for Wyoming – it’s a pdf that tells you exactly how many visits you get, how many visits are covered, how many sessions are covered. Some monthly promotions. Corrections has their own area in here, so they can check that out. Here are the four areas of help: eap services, work life services, legal services, and financial services.

EAP is more about mental health. You can see what kind of things are covered here. Their counselors are experienced, and they can cover these sorts of issues. There are a few things that aren’t covered, but you can get three sessions with a counselor for free.

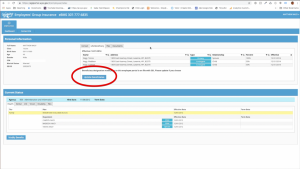

Work life services is about elder and child care issues. If you’re caring for people; family care issues. If you’re having those kind of issues come in here and check it out.

We all know what legal services are. They have a ton of resources over here on the right. You can talk to somebody about any legal issues. Tells you how it works right here.

Financial services… read through here, find out what you might need. Here’s a bunch of resources again over on the right.

You can scroll through here and see what other sorts of things they got going on. Here’s the same stuff… legal services, financial services…. you can subscribe to a newsletter, you can look at past newsletters, you can look at past webinars, sign up for webinars. That’s the kind of stuff that you have up here as well. They have manager resources; helpful documents and a blog for managers. They have a ton of training and webinars through here on all sorts of things. Same with this, it’s in demand stuff. So look through here there are topics galore and helpful articles. This is just the online intake form just like the contact request form. If you don’t want to call you can go ahead and fill this out… now, you will be getting a call once you do fill this out, but this will give them a good idea of what you’re talking about so maybe you can talk a little bit less to the folks setting it up.

I’m going to scroll down here and just show you that there are monthly featured articles down here: CBD, articles on returning to school, COVID-19, tension stuff, and a ton of featured topics down here. this is all free to us and help from actual humans, up to a certain point, is free to us as well.

So, there you have it. A new benefit from the State. I actually have already used the financial aspect. I have been doing a side gig for about 20 years with UW Athletics… part of the production crew for the big screens and streaming of games. Well, as you know, fall sports have been canceled, so I decided to call FEI and see if there was any federal money I might be able to tap into. As of now, the PPP program is not giving out money, so I’m just going to have to deal with making less this year. Unless they actually do the games in the spring… But, the guy I spoke with was excellent and gave me all the information that was out there.

Alright folks… thanks for joining me on the Subject Matter Minute! I’ll see ya next time.