The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #19 -Open Enrollment.

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello and welcome to a very special episode of the subject matter minute. This is the “episode after the crash.” Just last week, or maybe it was the week before, my hard drive crashed… kind of. For those of you in the know, this was actually a RAID, so in theory… it’s got six hard drives in it, and if one of them dies, it can recover all the information when you put a new hard drive in there, and rebuilds it, and all that jazz. Well, it acts like it rebuilt it, but I can’t get the hard drive to mount. In other words, show up on my computer. So I can’t access all my files, which means that my original projects are on there, and all the little fancy graphics that I worked on. Granted, it’s probably about time I rebrand my show, but I wasn’t quite ready for it this month. So this show will be a little bit dumbed down. Still gonna have some amazing content, but you won’t see the usual, or at least some of the usual pomp and circumstance. Maybe I’ll be able to pull some of it, I don’t know. In any case, a little bit harder for me this episode, but hopefully I’ll get it all rescued by next time or it’ll be a whole new show with different graphics because I’ll have to rebuild it. Anyways, I’m gonna be welcoming you again when I start the actual show… thanks for joining me.

__________________________________________

Hello and welcome to another episode of the subject matter minute. If this is the first time you’ve tuned in, my name is Matt Nagy and I’m the e-learning coordinator for Human Resources Division. Now generally on the show we cover state benefits. So over time I’ve become curious what you guys think of them. So today I have created a tiny little survey that I would love for you guys to fill out. Basically, I want to find out your general feeling about our benefit package, and I also want to know which benefit you think is the best. The link is down below… just a little bit of interaction in the show here, if you wouldn’t mind. Go on down there click on that and it’s gonna take maybe 20 seconds of your life to fill it out for me. It is anonymous, so I won’t know who hates the benefits and who doesn’t.

Before I get started with this topic I want to thank last month’s subject matter expert who was, of course, Employees’ Group Insurance. And that leads me right into thanking them again for being this month’s subject matter expert. Like usual, they’re helping me out all the time.

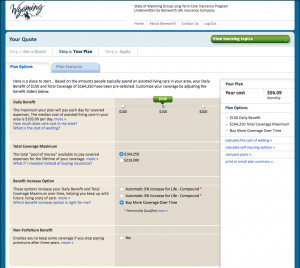

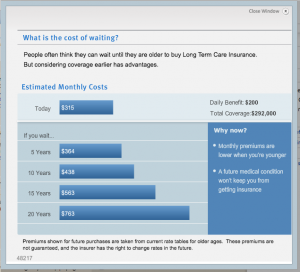

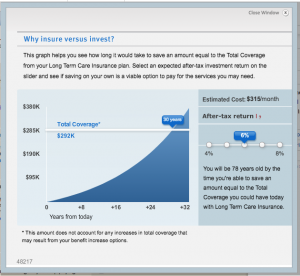

Last month was long-term care insurance. If you didn’t see it, check it out. This month’s topic is something that you hear about every year about this time of the year. I think sometimes it goes in one ear and out the other… kind of depends on your situation at the time. Today let’s talk about open enrollment.

Open enrollment is simply a set amount of time that you have to add, drop, or change your benefits. Specifically the time period is October 1st through November 30th. If you try to make changes after November 30th you will not be able to, you need to do it during open enrollment.

There are three groupings that you need to consider during open enrollment. One are the guaranteed things to either add or drop. These include health insurance and preventive dental. Next, there’s a group of things that have rules or time periods associated with them, and those time periods need to be up before you can make changes. And then the third group are the things you need to consider every year… basically you need to sign up for them every year.

The guaranteed benefits, like I mentioned, are health insurance and preventive dental. You can add those every year during this period. You can also change your health insurance deductible amount, and you can add or drop dependents. Something you need to know is if you’re going to add dependents, you need to have supporting documents such as birth certificate or marriage certificate.

There are two benefits that have waiting periods… these are optional dental and vision. With optional dental, if you did not sign up when you became a new employee or if you dropped it along the way at some point, there’s a three-year waiting period before you can enroll again. Same with vision… if you didn’t sign up as a new employee or if you dropped it along the way, with vision there’s a two-year waiting period. Another side on vision is when you do enroll, you have to be enrolled for two years. You can’t drop it that next year.

Now let’s talk about the benefits you need to consider every year as far as enrollment goes. These are the flexible benefits, which includes the medical reimbursement account and your day care reimbursement. You have to enroll in those every year during open enrollment. This makes sense because you have to decide how much money you want taken out of your check for both of those items.

There’s one more item with flexible benefits. During this period you can also change your tax election to pre-tax or post tax. If I’m making no sense to you as far as flexible benefits goes, EGI has a video that you can go check out talking about them, explaining everything that I was just talking about and more. The link’s down below in the show notes.

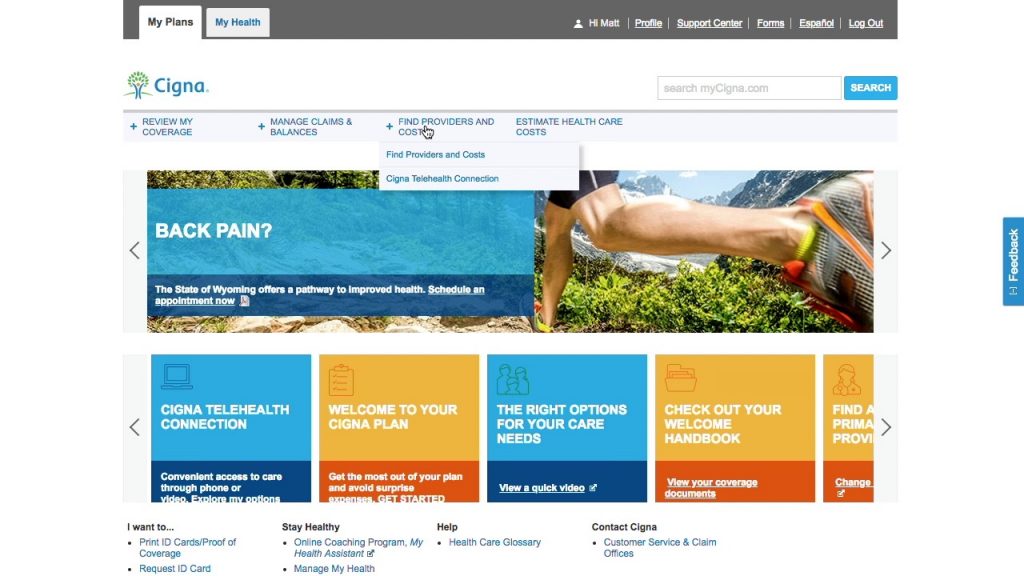

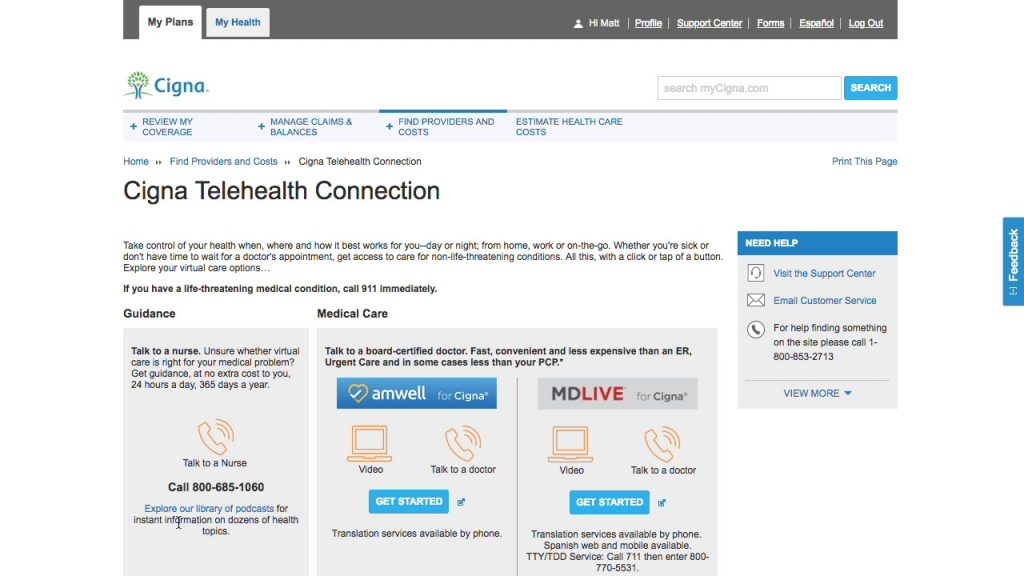

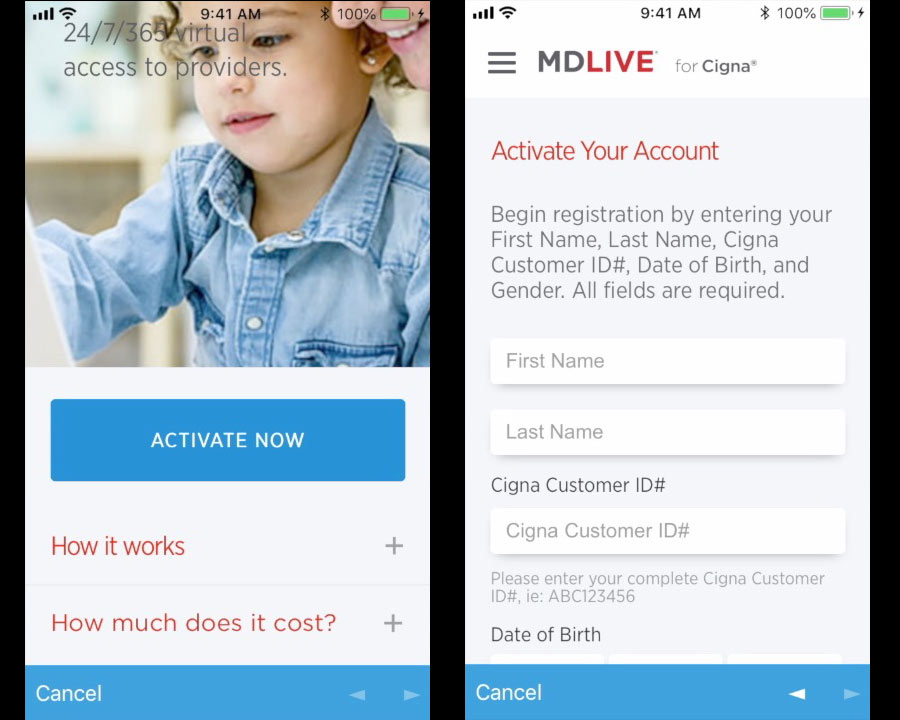

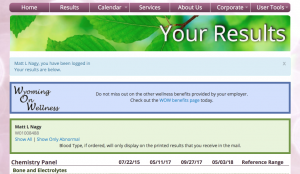

The nice thing these days is that you can make all these changes in the egi portal. I have a link to it down below in the show notes and you can also go to their web page to find it. So get in the portal, make your changes… at least see where you’re at with your benefits. It’s very handy.

Alright I think that’ll do it for today thanks for tuning into the subject matter minute and I’ll see you next month!