The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #18 -Long Term Care Insurance.

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello fellow state of Wyoming employees, thanks for joining me on another episode of the SMM, I’m Matt Nagy. A couple of you may have noticed… it’s unlikely… but I skipped the last episode of the subject matter minute because I was burning vacation in July. It was great, and it was really hard to get back to work, but basically, I got a river trip in, I had a staycation, which was actually supposed to be a supported mountain bike trip, but due to fires in Colorado, it got cancelled… but I stayed home anyways, that was a blast. Then we went to Walla Walla for a long vacation… Walla Walla Washington to do some wine drinking, or tasting. It’s kind of more my wife’s gig, but we had a lot of fun… we had good friends with us. So so in the end I didn’t feel like I had enough time to get her done, so I took a month off. If you were waiting with bated breath, I hope you took a breath, and I’m very sorry.

I want to thank the subject matter expert for that last one, which was EGI who gave me the information for telehealth. I think that a lot of you found that information useful. I got several comments about people not knowing about it, and basically, it’s a pretty inexpensive way to get a doctor’s opinion. So thank you EGI.

On that note, this month’s subject matter expert is once again EGI. We’re burning through all their benefits. This one’s loosely a benefit because it’s a voluntary benefit, which means it puts it in the same area as vision and long and short term disability in that the state doesn’t actually kick anything in. So it’s a benefit still because we’re getting group rates because of our numbers.

This episode we’re going to be talking about long-term care insurance.

Long-term care insurance… what is it? Basically, it is insurance to provide money for custodial care if you’re in an accident or get some sort of long-term disease like cancer… it’ll help pay for custodial things such as bathing, cooking, feeding, dressing… you know? If you get to that point, you forget about those, and those aren’t covered by medical insurance because they’re not actually medical items.

So that’s the what… why would you want to do it? First of all, it can help protect your retirement income. I say “help” because these sorts of scenarios can get very expensive. It can also help protect your family and friends from the burdens of continual care. It can help you choose where you want to get your care … it can be at home or in a facility or a combination. And that leads to the next one which is it allows you to bring someone into your home for care.

We need to keep in mind… when you think about long-term care – if you’ve thought about long-term care – we think about that being for the elderly or for when you’re really old. That’s not necessarily the case. If you have an accident or you get a disease like cancer, this coverage can kick in way before your old age.

Like I said, many people think that health insurance will help pay for this sort of stuff… it does not. Health insurance covers medical items only. This helps with custodial things… day-to-day activities. Another thing people think is that the government will kick in for this sort of thing. Well apparently that’s true, but you have to basically use all of your retirement savings, and sell off all your assets before the government will truly kick in. Some people think that they’re gonna have enough retirement to do this. Some people might, but it can get very expensive. I’m gonna go to their website and show you some stuff… the numbers are huge… you’ll be surprised.

For instance, my grandma… over ten years ago was put into – it was either assisted living or a nursing home or a combination place – that cost six thousand dollars a month, and this was a long time ago. It drove my grandpa crazy because it was destroying his retirement savings.

I kind of see this as a an insurance for the middle… all of us in the middle. If you’re broke when this happens to you you’ll probably get some help. If you’re really wealthy, you’ll probably be able to cover it. But if you’re in the middle, like most of us, this could help.

Their website is very useful… it has all these questions that I answered already, but you can read read through them again, and it also has a way to find out what your monthly cost will be. And because there’s lots of variables, you can change how much you get per day, you can change the overall amount, you can make it go up by a percentage every year to kind of keep up with inflation… so I’ll stop there and I’ll just go straight to the website and show you what you can do.

Because this is a voluntary benefit, a different company puts it on… this company is Genworth. so you go to Genworth.com/groupltc. The user is statewy password is groupltc, then you select your state, and then you select the applicant type, so I’m doing an employee as opposed to spouse. Then you click get started.

This has a bunch of information that you should read before deciding.

Why consider long-term insurance?

What does it cover?

Some misconceptions?

Why consider this program?

And then it goes over the Genworth the company. Whether or not it’s a good company, how long it’s been doing business…

Then you can look at questions regarding the plans:

How do I choose my coverage?

What features are included?

What additional options?

What happens when I need it?

What is not covered?

Definitely read through it all.

They also have a section about how to apply. Now I’m gonna go in to get a quote… I’m gonna go through this real quick. I’m gonna say it’s just me… you would say yes if it’s a spouse. Then you put in your birth date, where you are gonna retire… I’m gonna say rest of state, cuz probably not Casper or Cheyenne, and then click “next step.”

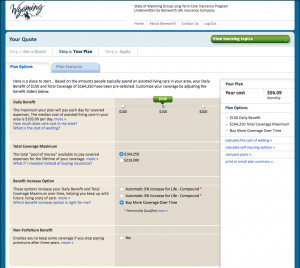

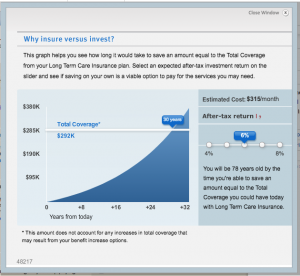

This is where you can adjust things to change your monthly fee. Right now it’s $56.09, and that means I’m gonna get out a maximum of a $150 a day for care, and a maximum (complete maximum) of $164,250. You can adjust… you can say, “how about if I just want hundred dollars a day?” That changes it to $37 a month. Or maybe let’s just go clear up to the two hundred dollars a day… now it not only adjusts the the daily but it adjusts the total coverage, so that’s $219,000 total. Alright, you really want to see it jump up let’s go to the max. $85 a month… not terrible, but if I want this amount to increase by a certain amount every year to keep up with inflation – let’s just do the three percent – jumps up to $189 a month. But, your total will increase yearly for life. At five percent, the highest you can do, it is $315.22 for my birth date.

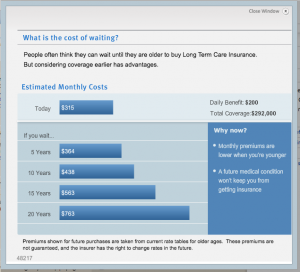

Now there’s some things here that you need to look at. Let’s calculate the cost of waiting… that means if I were to do this plan in five years it would cost me $360 for a month, in ten years it will cost me 438. That’s a nice comparison as far as should I wait or should I start this now.

The other thing is here calculating self-insuring options. So this is how long it would take me to save that amount of money at 6%. I’ll be 78 years old by the time I have $292,000. now if you do it that way you should realize you won’t have it till your that age, and you hope that your problems start after that. With the coverage, you can get payouts earlier if things were to happen earlier.

Also you can compare plans and you can print out a plan summary.

One thing I want to show you that I had to back up to the Learning Center… I want to show you the cost of care in your area. So, this is a way to see how much it costs right now to get this sort of care. If you go to your state, and let’s do annually, and let’s say cheyenne, because a lot of you are in cheyenne. So this is how much it costs annually in Cheyenne right now for these sorts of things. Right now for a Home Health Aide, it cost $51,000 a year. You’ve got to keep in mind, too, that these sorts things are going up by this much every year. So assisted living facility… $55,000, but it’s going up seven percent a year! Let’s say you need it in 20 years… it’s gonna be way more than this. And consider this private room in a nursing home… $101,000 now, going up at three percent.

As you can see, the website is very handy, has a ton of information, and allows you to look at some numbers.

I hope that helps with your decision-making process as far as long-term care goes. As with most things in this insurance world in this area the younger you get in the cheaper it is per month, so consider it.

That’s it for this episode! Thanks for joining me on the subject matter minute I’ll see you next time.