The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #22 – Health Savings Accounts.

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello and welcome to another episode of the Subject Matter Minute, I’m Matt Nagy, thank you for joining me. Before I get started on today’s episode, I want to first thank the subject matter expert from last episode, which was Wyoming retirement system… specifically Polly Scott. She always makes sure that I’m not making stuff up and that I’m getting things right. Thanks!

Also, a couple episodes ago I briefly mentioned something about my daughter that I wanted to talk about get off my chest. I don’t know if you guys remember but back in the day, I mentioned that my parents had given us a Subaru Outback for our daughters to use. An older model, but a fabulous car that they had bought new. So my older daughter got to drive it. Well, within three weeks she totaled it. Don’t worry she, was fine… it was a low-speed thing. Then after that I had a 93 Camry that I bought from my parents a while back. I put enough money into it to make it tip-top. So I let her drive that and about five months ago she totaled that car. Again, she’s fine. This one was in Ridley’s parking lot, right into a pole… dead center in the front. I mean crushed it. I’m glad she was fine, but heartbreaking two wonderful cars down the tubes. She had to buy her next car herself, obviously, and now my younger daughter turns 16 so she is driving as well. We set her up with a really cheap 97 Sentra, and and we also tried to change her behavior with some promises of helping her with a car after high school if she doesn’t total this one. I don’t know if it’ll help, but so far so good with that one. Thanks for letting me tell my story and get that off my chest. I know that speaking to people when I tell this story that others deal with this, so a lot of you out there feel my pain.

Today I’m gonna talk about something related to our healthcare plan. It’s a change you can make if you can afford it, and if it works for you. Today I’m going to talk about health savings accounts.

Health savings accounts, also known as HSAs.. Before I go into that I want to thank this month’s subject matter expert on this topic which is Ralph Hayes of employees group insurance. Of course it’s employees group insurance, right? Ralph helped me out, and he actually has been doing this personally for a while and he’s a believer in it, so he was the perfect person to help me out with this information. Thanks Ralph.

An HSA is like a personal savings account but it is used for health expenses, medical expenses. Set up in 2003 by the government to allow those folks who had high deductible health plans a way to pay for current expenses and future expenses, in a pretty tax favored way.

So in order to take advantage of an HSA you have to, again, have a high deductible health plan, and like the name says, a high deductible health plan has a high deductible. Currently the state has one plan or two plans, that you can use. For an individual, it’s the $1500 high deductible health plan, and for an employee with a dependent or basically families, it’s a $3000 deductible. Now keep in mind that while we the deductible is high with these, it means that your monthly premium is lower. Take me, for instance. Right now, I have a family plan at the $500 deductible point. This means that my premium is about $260 a month. If I go to the $3000 HDHP plan, my monthly premium goes down to about $63, so about a two hundred dollar difference there.

So if you go with this qualified plan that the state offers, you can open an HSA.

Something to know is that the state does not contribute to this plan and the reason I say this, the reason I tell you this, is because after all my reading I found that actually a lot of employers do contribute to HSA. Kind of as a benefit. But not at the state, you have to fund this yourself.

In 2019 you can contribute up to $3500 as an individual into your HSA, or $7000 as a family. At age 55, they give you a little extra room, if you can afford it, you can put another $1000 per year into your account.

First I want to talk about the advantages to an HSA. The big one that caught my eye and got me excited is you get a triple tax advantage. 1. Contributions are tax deductible, which means that you can either pull the money pre-tax out of your check, or any money that goes into the account after tax is deducted from your gross income on your tax return. 2. Earnings are tax-free. A lot of these counts you can earn money, like an IRA basically, and these earnings are tax-free. 3. Withdrawals are tax-free if they are used for

qualified medical expenses. So you’re talking a bunch of tax-free money right there.

Another advantage is funds rollover forever. Once you put them in, they’re yours. This is not like a flexible spending account, where you use it or lose it… this is your money to keep.

As I mentioned briefly the money in this account is invested in the good programs and can grow. There’s a lot of HSA providers out there, but you want to get one that, if you have excess in there, it can be invested like an IRA, and it can grow.

Another advantage is that it’s portable. The money is yours, again, even if you change plans, change jobs, or you retire.

Another advantage is the HSA can be used for retirement after age 65. You can still use it for health expenses, but you can also use it for anything else without penalty. I’m going to go into this penalty thing in just a minute, because now I want to talk about the disadvantages of an HSA.

The number one disadvantage, obviously, is the high deductible. It can be really difficult to come up with that kind of money for the deductible, especially in the first year or two of doing an HSA. That’s understandable.

Number two… unexpected health care costs. Kind of the same deal… if you aren’t putting enough money into your HSA, or it’s early on in your process, the first couple years, you might find it hard to pay for unexpected health care costs.

Now taxes and penalties… I mentioned this earlier. While you’re allowed to withdraw the funds from these accounts for anything that you would like to, if you pay for non qualified items you will have to pay income tax and a 20 percent penalty. I mentioned after 65 you don’t have to pay the penalty. You’ll still have to pay income tax on it, like an IRA, but no 20% penalty.

One last disadvantage is the pressure to leave the money alone. You may be reluctant to seek out medical care because you don’t want to spend that money that’s over there making money, and of course we want everyone to get medical care when they need to.

So really both healthy young people on a budget who want to reduce their monthly payment and families who can afford the high deductible and possibly max out the account, these are the kind of folks who might find these accounts especially beneficial.

Let’s let’s consider my situation for a second. This is me considering this whole thing. If I were to put the two hundred dollars a month that I saved by going to the $3000 deductible plan, I’ll be putting aside $2,400 a year. Not quite the deductible, but honestly we haven’t spent that much as a family for several years several years. Mostly because we’re done with braces and that sort of thing, but we’ve also been pretty healthy. So even at that contribution level of $2,400 a year I could probably expect some money to roll over, and then the account would grow.

Something to keep in mind if you’re thinking about expenses at this point… preventive care is still covered with a high deductible health plan at the same rate as it is now with your lower deductible.

If we were to put a little bit more into the HSA we could get it up to the $3000 deductible pretty easily… with $50 more a month… so a total of $250. That would get us to the deductible. Now, if we wanted to take it even further, I’m sure a lot of you, like me, use the flexible spending account, and typically we put in over a hundred dollars a month. If instead, we put that to the HSA, let’s just say a hundred, that would put us at $4,200 a year in our HSA. So even if you hit your deductible and paid your $3000, you’d have a little bit to roll over. Now, there is coinsurance and all that to take into account too, but $4,200 a year, if you don’t spend it all, you might be able to roll some over.

If you’re spending all the money in your HSA every year, then you are losing out on the growth benefit. However, at least you aren’t worried about the use-it-or-lose-it aspect of the flexible spending account, right? You’re getting the same tax benefit, but you don’t have the stress of trying to spend the money or having to do it by a certain date or buying things you don’t need (like these classes I got, and I got another pair of sunglasses this year because we didn’t have medical expenses… so I bought some computer glasses and then some sunglasses for in the car). You get that tax benefits but you don’t have to worry about that if you go with an HSA.

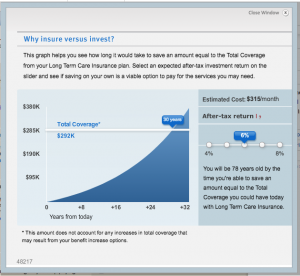

After after having said all that, trust me, I don’t know the best route for anybody, including myself. I’m just trying to wrap my head around this concept and see if maybe it would work for us. I do know that health expenses in retirement are one of the top expenses, and it’s serious expense. In fact, the last number on the average that we’ll spend on health care in retirement is $280,000! I’m not saying that the HSA will get us there, but it could certainly help and pay a chunk of that, and certainly in a incredibly tax advantaged way.

Again I want to thank Ralph for getting me this information. I find it very interesting. I hope you do too. I’m not telling anyone what to do financially. If it works for your family great, if not stay with that sweet low deductible plan that you have and be happy about it.

Thanks for joining me on the Subject Matter Minute, and I’ll see you next time!