The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #34 -Air Ambulance Coverage.

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view on YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello All! So, last month’s SMM was on COBRA. I think the general consensus from the feedback I got, was that all of us will have to work until we are Medicare eligible. Sad, but true.

Thanks for watching that episode and thanks for joining me today! If you didn’t watch that episode, or you’ve missed some others, I went ahead and posted a link to the SMM playlist in the show notes below the video. If you haven’t checked out the show notes before, I want to mention that you almost always have to click the “show more” button to actually see what’s in there. For some reason, YouTube gives very little space for it.

Alright. Today we are going to talk about the cost and/or our coverage of Air Ambulance service.

So, I started thinking about this, unfortunately, because a friend of ours was involved in a car accident that sent someone in a helicopter to Denver. We spoke with them and naturally began talking about car insurance and health insurance. Totally unrelated to this episode, but your car insurance is unlikely to cover much in a multiple injury and/or death type scenario. You might check out what your car insurance covers.

Anyway, we also spoke about the helicopter ride. Now interestingly, this is a bit timely, because both the legislature and the governor have also been talking about it. They are trying to create a new system to avoid the occasional huge charge that some have received after a medical flight.

Oh, by the way, when we talk about Air Ambulance, we are talking about both helicopters and airplanes. You can get a helicopter ride from the scene of an accident and either a plane or helicopter from the hospital to another hospital.

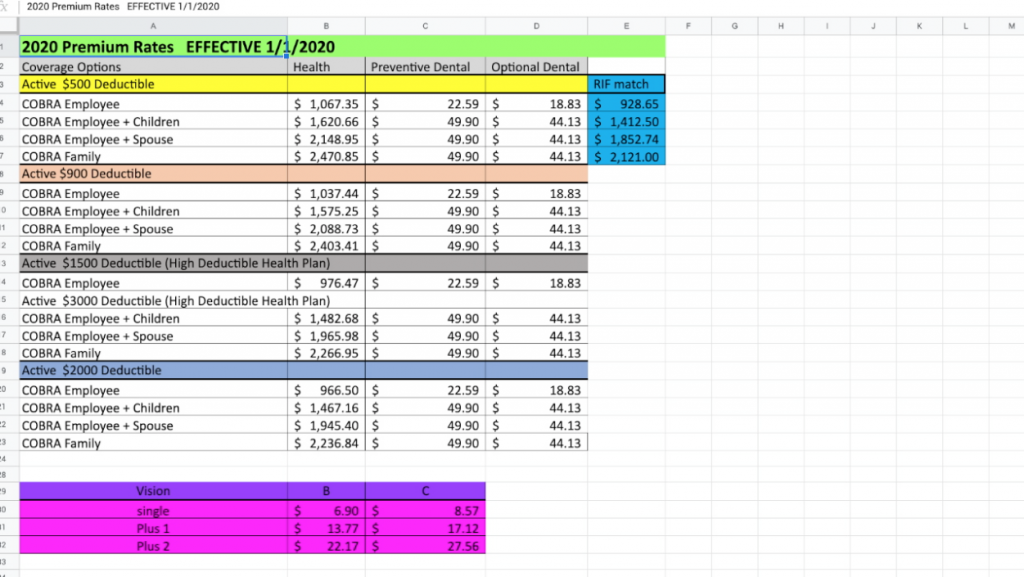

The price for this sort of service is all over the place. However, after speaking with Franz Fuchs of the Wyoming Department of Health, I have some numbers that are more pertinent for the State of Wyoming employee.

First of all, the claims for this sort of thing that EGI has dealt with average around 100 trips a year. They tend to be half plane and half helicopter with only about 10% of the flights being on the side of the road 9-1-1 calls. 90% are interfacility which can be by plane or helicopter. While either situation means you have been badly hurt, the flight from the scene type probably means you are worse off. Luckily, with only 10% being that type, there are only approximately 10 roadside flights a year. And this includes all the people that EGI covers.

The average that EGI paid for this sort of transfer (and this includes all the transfers… the 100 on average per year) was $33K in 2015 and went up to $36K by 2018. So EGI is getting a big bill.

Now, the average amount that a covered person paid… I keep saying “covered person” because EGI covers more than just State employees, there are some school districts and such…. Anyway, the average amount was just $250-$300. Franz pointed out that this number doesn’t really mean anything, however, as 70%-90% of folks paid close to $0. These were likely folks that had reached their maximum or covered their deductibles, ya know, different situations.

The actual maximum a person paid (that is covered by our insurance) in 2015 – 2017 was $3K, but there was one person in 2018 that was charged $10K. Honestly, we don’t actually know how much they ended up paying because the claims data doesn’t tell us. You can often negotiate that kind of stuff down.

So… after hearing this, it seems that state employees aren’t really the ones that the governor and the Legislature are talking about when they say that people are getting hit with huge bills. The bottom line is our insurance covers this sort of thing at least to 75%.

I’ve been asked to mention that Insurance companies have some coverage requirements for them to pay an air ambulance service, perhaps the most important of these is the one that says, “the service is medically reasonable and necessary.” So, in a situation, does the patient’s medical condition demand rapid and immediate air ambulance services? A broken leg probably does not warrant an air ambulance while bleeding inside the skull that warrants the medical intervention of a neurosurgeon might. Unfortunately, the patient rarely, if ever, has a choice or enough knowledge to make the call in this matter, so hopefully, the medical professionals are making the right decisions at the time. In this situation, it’s Cigna that makes this call after the fact… not EGI.

Now if you are in an accident that requires this sort of thing, you are obviously going to be dealing with a whole lot more than just a helicopter flight, but it is good to know that at least this piece is covered and won’t break the bank.

Also, if you do end up with a balance bill, I’ve been told that you should definitely do some haggling with the air ambulance company. They are often willing to accept a lot less than the bill if they can get it quickly or easily. I know that this seems weird, but it’s true.

I want to thank this month’s subject matter expert, Franz, of the Wyoming Department of Health for getting me the stats that have helped put our minds at ease. Thanks, Franz.

That’s it for today, check-in next month for another exciting episode of the Subject Matter Minute! See ya then!

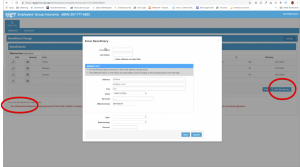

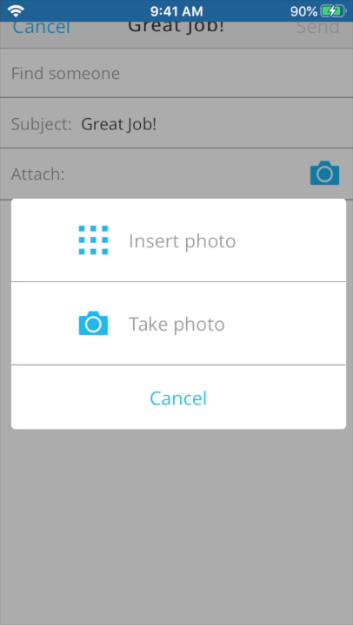

Hold up! Let’s go back a second. I recorded this and then realized there’s a very cool feature within the mobile app that you cannot do on your desktop. You can attach photos! So when you’re in feedback, you see the little photo or a camera icon… click on that and you can insert a photo or take a photo. So if you are giving feedback on something at the time that is right in front of your face, you can take a photo. Or if you previously had a photo you can go insert photo. Go into your photos on your camera… yeah better not, my wife had some pictures of her being very sick… Or take a photo. Allow it to use your camera, and look that’s me recording my phone.

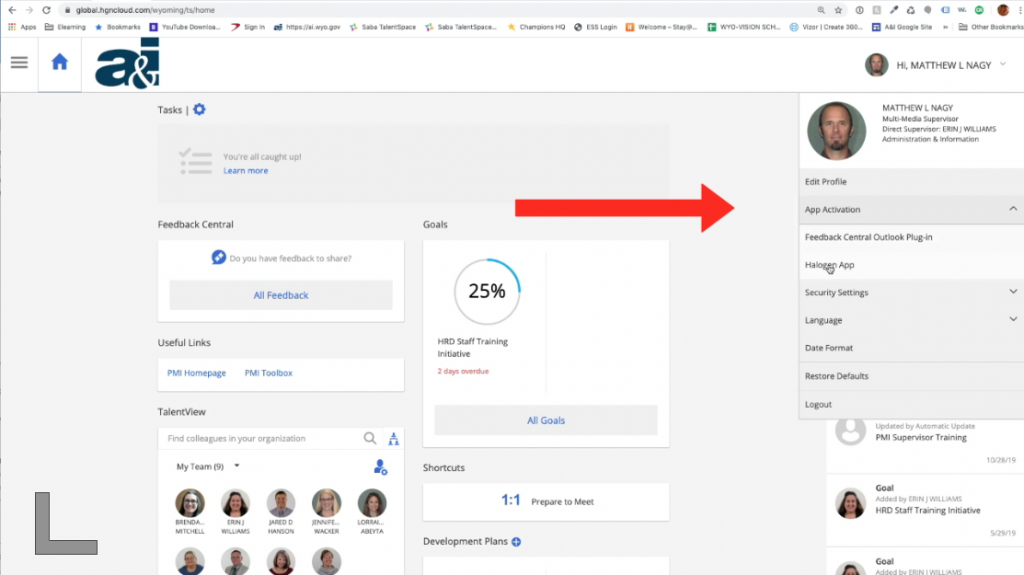

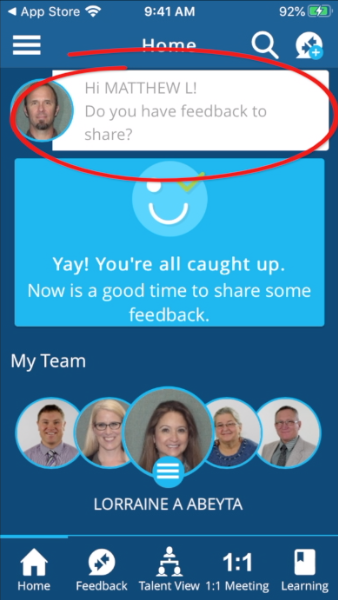

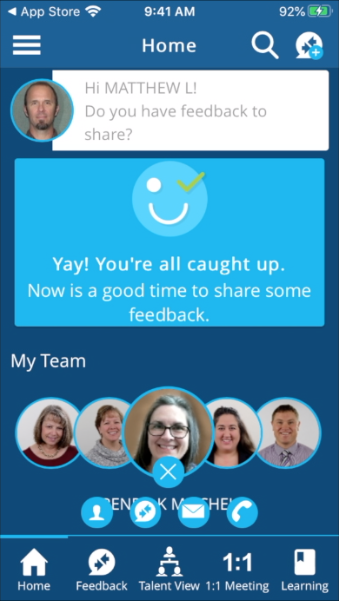

Hold up! Let’s go back a second. I recorded this and then realized there’s a very cool feature within the mobile app that you cannot do on your desktop. You can attach photos! So when you’re in feedback, you see the little photo or a camera icon… click on that and you can insert a photo or take a photo. So if you are giving feedback on something at the time that is right in front of your face, you can take a photo. Or if you previously had a photo you can go insert photo. Go into your photos on your camera… yeah better not, my wife had some pictures of her being very sick… Or take a photo. Allow it to use your camera, and look that’s me recording my phone. Another way is you can see on the home page the “my team” at the bottom. You can scroll through your people, and then either click on their face or click on the little three bars below their face and that’ll bring up icons. You can see the feedback icon is the second from the left if you want to send feedback to that person, or if you click on their face it brings up their face in a larger format and gives you some icons as well. You can send email to them, you can send feedback, and unfortunately you can’t call through the system right now. The telephone icon is grayed out. But that’s another way you can send feedback to your people right away.

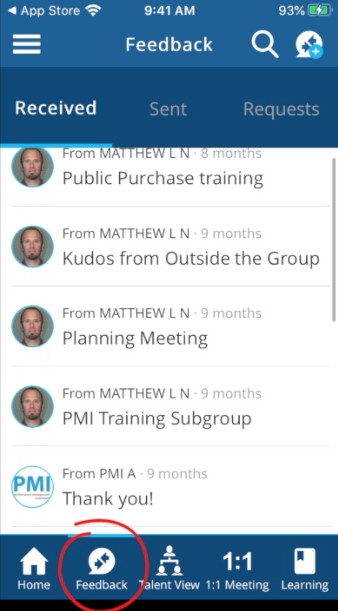

Another way is you can see on the home page the “my team” at the bottom. You can scroll through your people, and then either click on their face or click on the little three bars below their face and that’ll bring up icons. You can see the feedback icon is the second from the left if you want to send feedback to that person, or if you click on their face it brings up their face in a larger format and gives you some icons as well. You can send email to them, you can send feedback, and unfortunately you can’t call through the system right now. The telephone icon is grayed out. But that’s another way you can send feedback to your people right away. You can also look at your feedback that you have received or sent by clicking on the feedback icon in the lower menu. These are the received, and then sent, and then you can also look at ones that you have requested, if you ever requested any.

You can also look at your feedback that you have received or sent by clicking on the feedback icon in the lower menu. These are the received, and then sent, and then you can also look at ones that you have requested, if you ever requested any. So that’s talent view. Next let’s look at one-to-one meeting. So in one-to-one meeting basically it shows the agenda that you’re setting up. These are the agenda items that are automatically put into your one-to-one meeting… any feedback goes in there automatically. You can add an agenda item by clicking on the plus icon to the right of agenda. You can type in the title, describe the agenda item, and add it to your agenda. I’m going to discard that because I’m not making one right now. So that’s a nice way to keep things up to date for your next one-to-one meeting.

So that’s talent view. Next let’s look at one-to-one meeting. So in one-to-one meeting basically it shows the agenda that you’re setting up. These are the agenda items that are automatically put into your one-to-one meeting… any feedback goes in there automatically. You can add an agenda item by clicking on the plus icon to the right of agenda. You can type in the title, describe the agenda item, and add it to your agenda. I’m going to discard that because I’m not making one right now. So that’s a nice way to keep things up to date for your next one-to-one meeting.