The below post is taken from the Video Blog, the Subject Matter Minute. If it’s a little hard to read, it’s because it’s taken from the spoken word. You can view the episode on YouTube if you would like. Find it here: Episode #24 – Surplus Property

If YouTube is blocked for you or your agency, you can scroll to the bottom of this post to view it from Google Drive. (I would prefer you view in YouTube, so I know how many people have watched)

You can also listen to an audio version.

Hello, and welcome to another episode of the Subject Matter Minute, I’m Matt Nagy, thanks for joining me. First of all, I want to say that I forgot to thank my subject matter experts for last month’s episode, and that’s silly because this is the Subject Matter Minute. I want to thank Tricia Flores and Tricia Bach, both of HRD, for getting me the information. It was on the difference between HRD and agency HR. I’m hoping that I helped out with that confusion… I’m hoping I was clear enough. This month I want to thank Casey Baxter of surplus property. I asked him quite a few questions, kept peppering him with emails and he got me all the information.

Before I get started on that information that Casey got me I’m curious how many of you out there have heard of minimalism? I think there’s a Netflix documentary on it, and you hear it occasionally in articles, but basically it’s an anti-consumerism movement where you have less stuff, you purchase less… it’s just about decluttering. Well, I think it’s a good idea. I think it helps the environment, the earth, I think it helps your mental health, because you have less stuff to deal with, and of course it helps your pocketbook. You save money if you don’t buy stuff.

All right, I feel like I need to say here that if you guys saw my garage you would not think that I’m a minimalist, okay? But I’m trying. I’ve gotten rid of quite a few things, and I think I’m more aware of purchases.

But on that note minimalism, today I want to show you guys how to get more stuff! [Music]

Wyoming’s surplus property… today I want to show you how to register for an account on the auction site, and how to use it. The process that I’m showing you today is for how to make a personal account, because anybody can buy off of this. If you need to become an authorized user for your agency, you need to contact surplus property. You can contact them at 777-7901 or ai-surplus@wyo.gov.

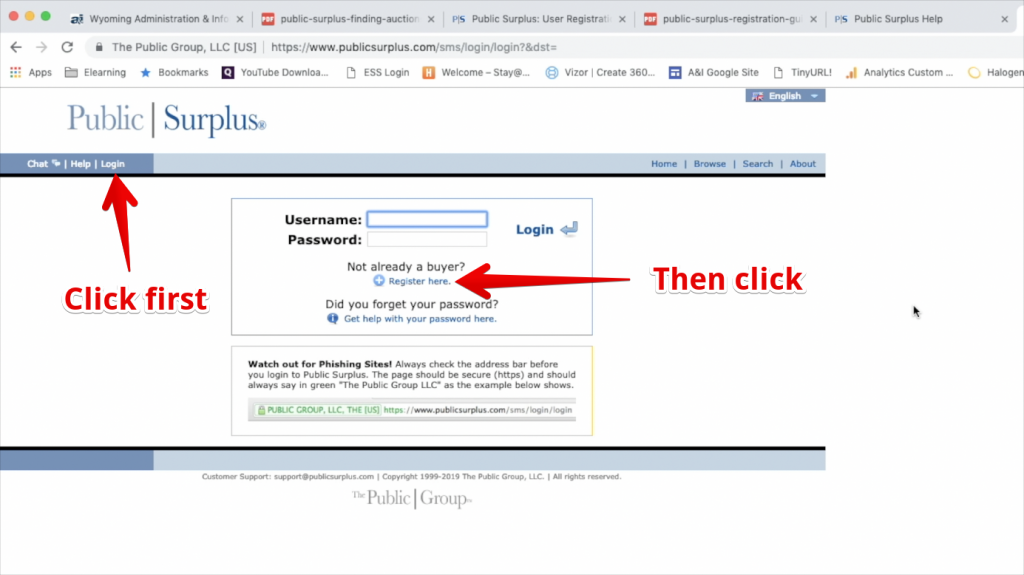

First I’m going to show you how to register. There are a couple verification steps, but it’s pretty simple overall. First of all you go to publicsurplus.com, and click on login. Next you want to click on register.

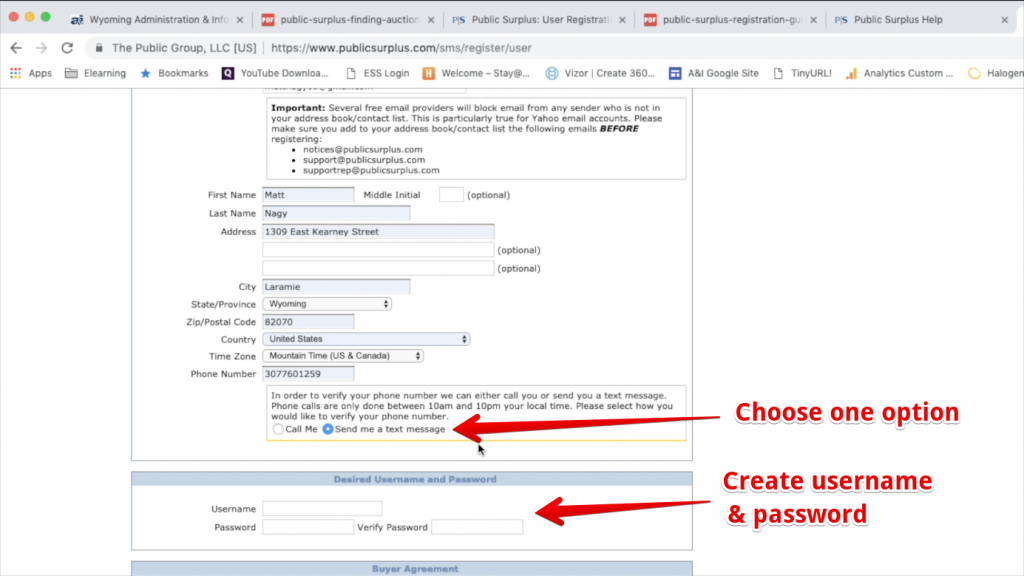

You need to fill out all the required information. You can tell that it’s required because it does not say ‘optional’ next to it. You also have the option of choosing ‘call me’ or ‘send me a text message’ for one of the verification things. Personally, I’m gonna do a text message. It’s quicker and easier I think. You’ll see what I mean down the road. Then you need to make a username and password.

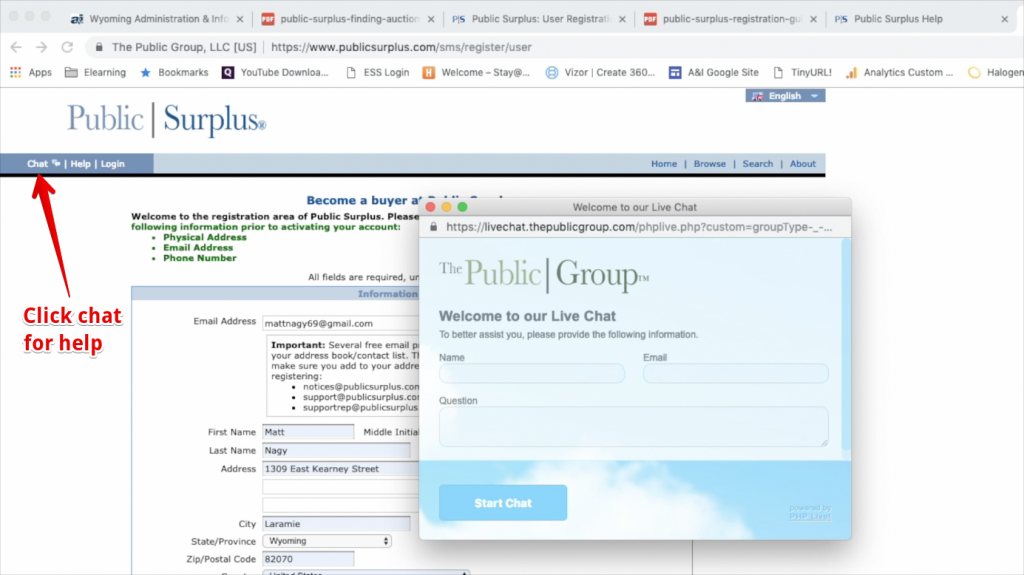

Once you got all that you come down here and you read the buyer agreement. If you have questions about the buyer agreement, you can come up here, click on chat, and you can do a live chat. Ask them your questions and get back to work. Or you can email public surplus at support@publicsurplus.com. Once you got your questions out of the way, and you’ve read the buyer agreement go ahead and click ‘I have read and accepted the buyer agreement,’ and click register.

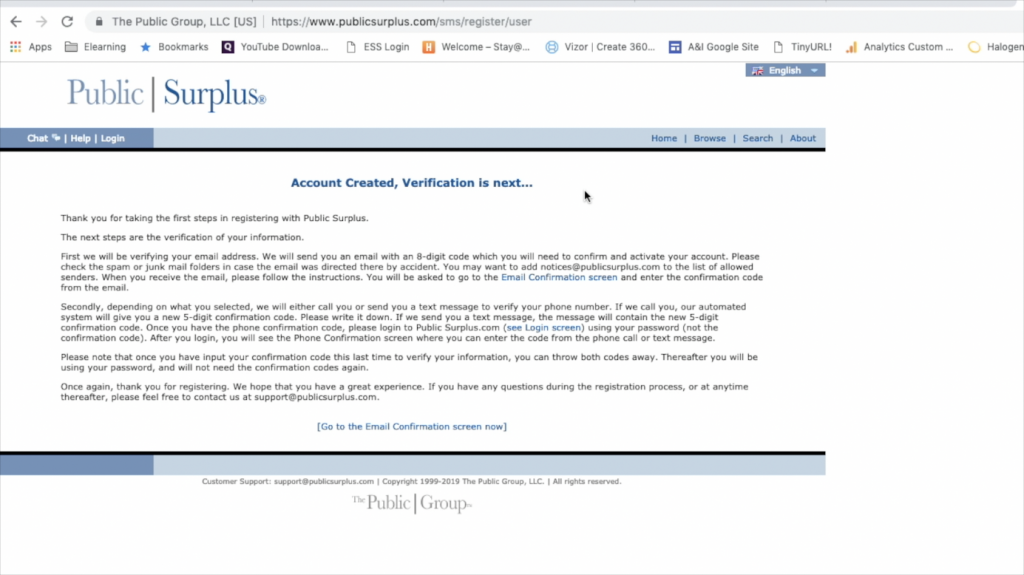

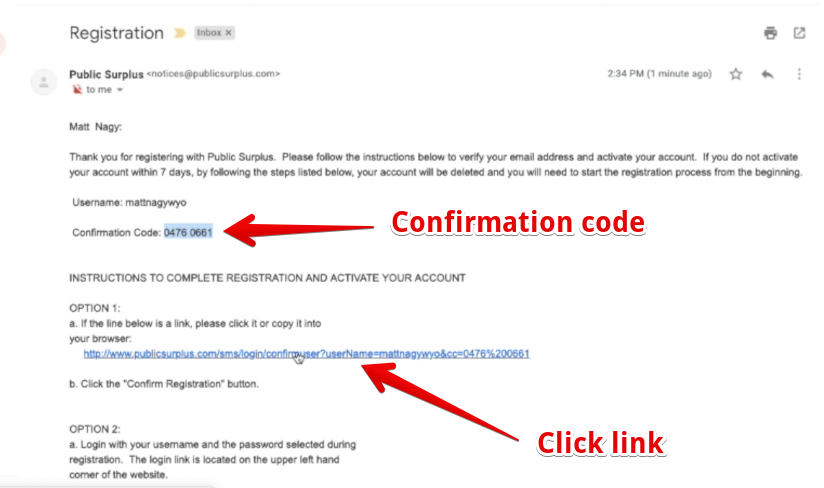

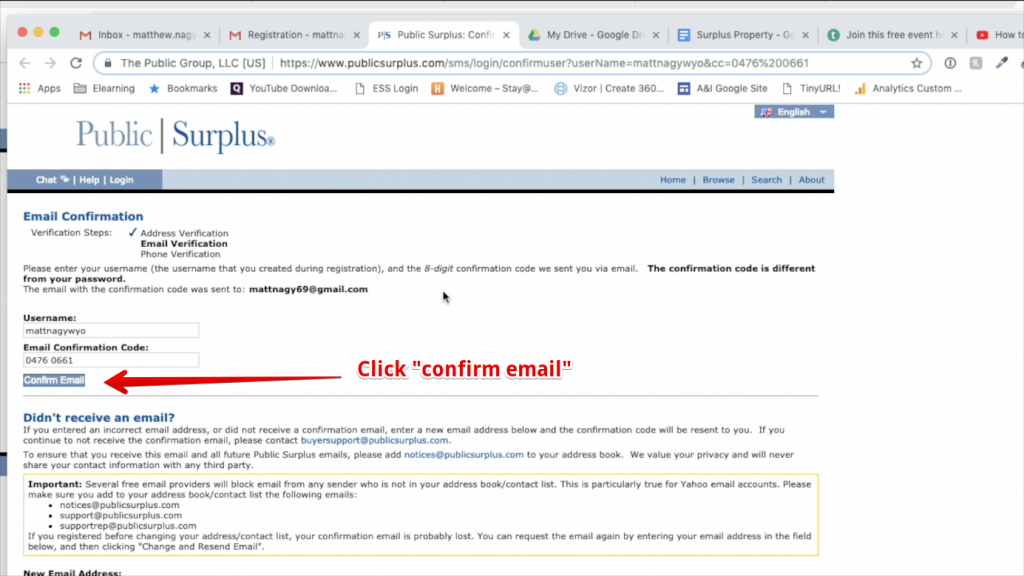

Once you’ve done that, you come to this screen where it says account created, verification is next. This is where you’ll need to check your email and get the eight digit code that they send you. Check your email and here’s the information code. Click on this link, like they asked you to. It brings you back to public surplus and it actually auto-filled the code and my username. At this point go ahead and click confirm email.

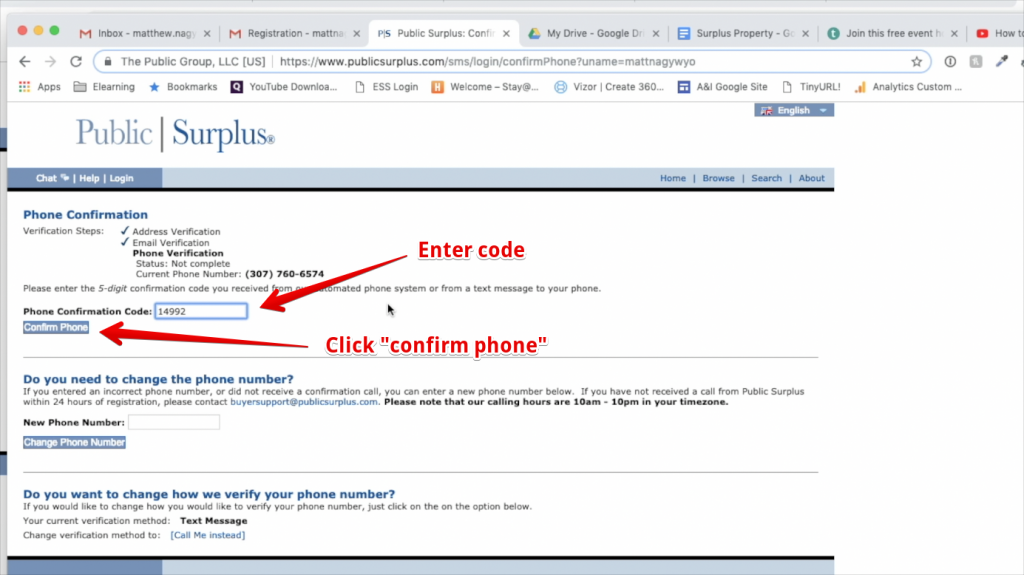

Now what it’s going to do is send you your text message or call you, depending on which one of those things you chose, with another code. What they’re doing here is just making sure that they can contact you… they’re not going to give out your information to anybody. Go to your phone – either answer it, or check your text, add the phone confirmation code, and click confirm phone.

Once you do that you get this screen that says thank you for confirming your information your account is now active, so you can click on the login, and type in your username and password.

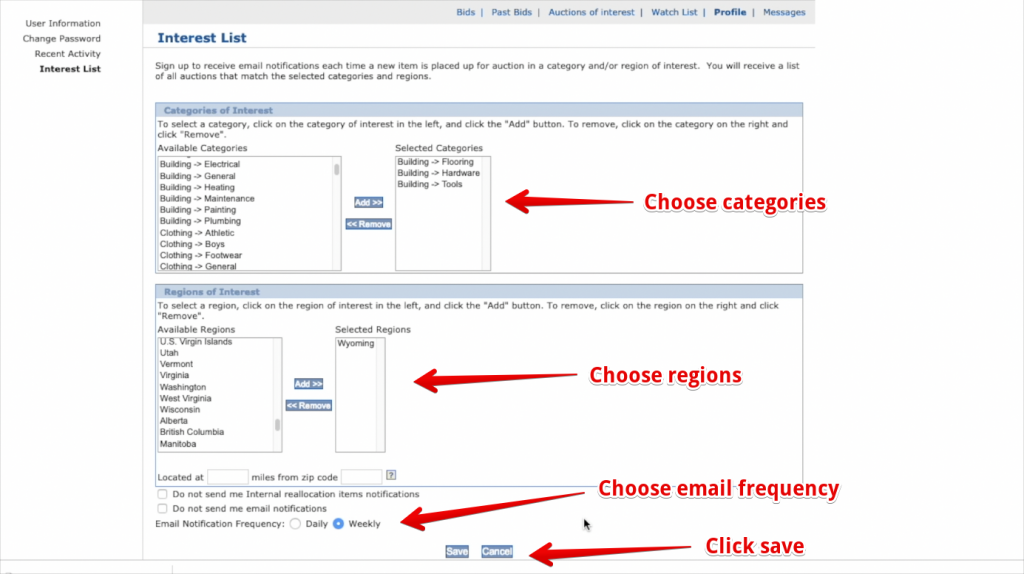

When you first get in, the very first time, this is a handy little feature. What it says is you can select categories, regions, and miles from a given zip code, and let public surplus notify you when something new comes up. So if they match something to your preferences they’ll send you an email. I’m gonna add a couple things. I’m gonna say building stuff. I like tools. I’m gonna add that. I like hardware. I’m gonna add that. I like flooring. Then I’m gonna come down here and choose Wyoming.

Now choose your email notification frequency. You may want to change from daily… depends on how much stuff you need I guess. You can say ‘do not send them’ or change it to weekly, which is what I’m gonna do. I’m gonna save that. Now I’m gonna go to browse. I am now registered and ready to go!

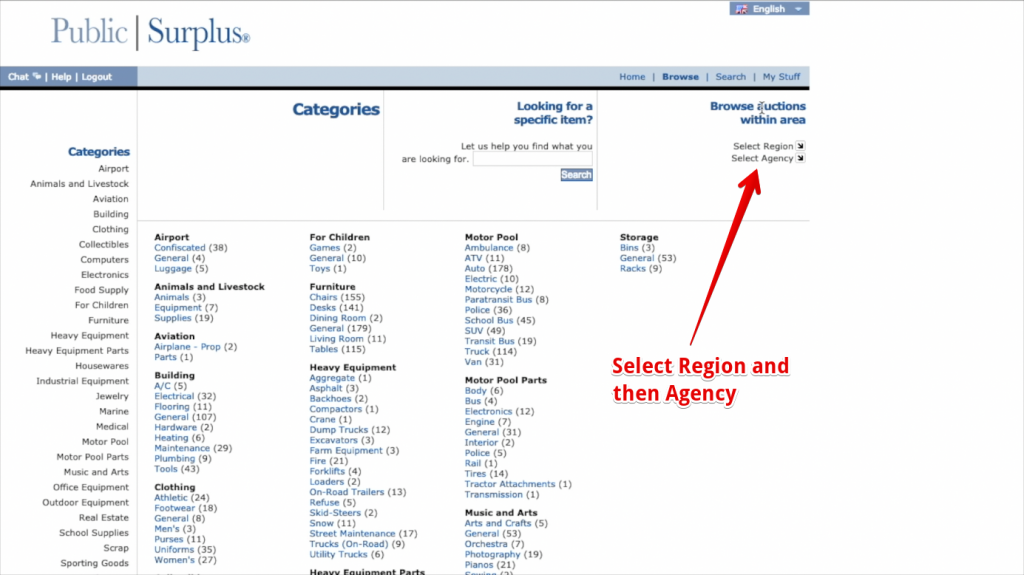

The first thing to know is that you are actually looking at everything, everywhere. Public surplus doesn’t do this for just the state of Wyoming, they do it for all sorts of organizations and state entities. You can buy from any of these places and odds are pretty good they’ll ship it to you, so feel free to shop here, but if you want to do something more close to home, you can start right here. We’ll select a region, and we’ll go ahead and hit Wyoming. Then we’ll select an agency… I’m gonna select state of Wyoming.

This brings up the side navigation. You can also click ‘view all auctions for the state of Wyoming,’ and that will show everything. Currently, there’s about two pages worth of stuff. Let’s look at industrial equipment. You can see how much is in each section. It shows you over here that you’re in industrial equipment and here’s all the subcategories and we’re in woodshop… there’s three items in there.

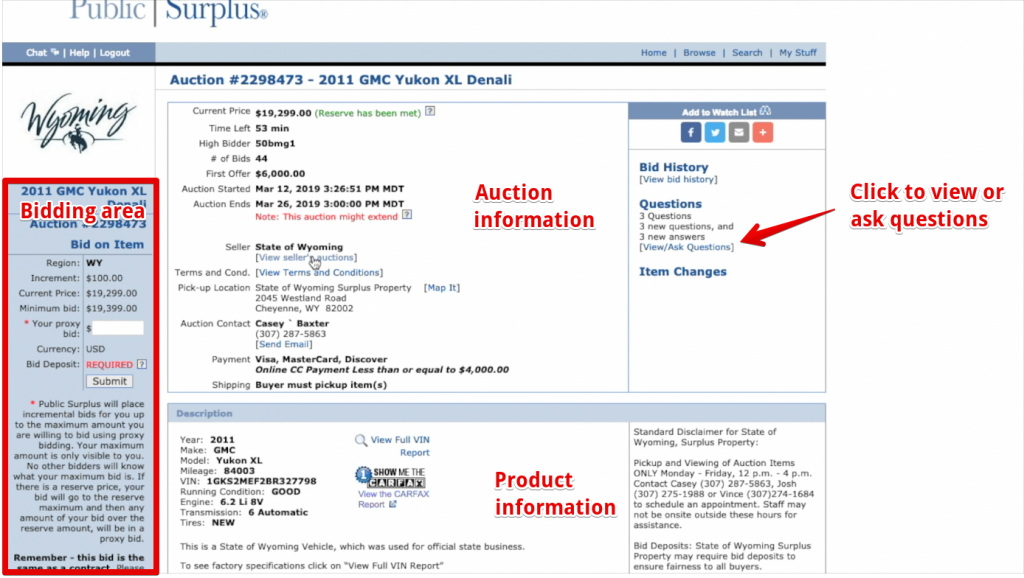

Let’s go ahead and look at motor pool, I think a lot of people buy cars off this. Here’s the current pile of cars they have available. You can navigate through this through the categories or you can search. I’m gonna look for that denali. If I knew exactly what kind of car I wanted, or what kind of piece of equipment I wanted, I can search here and it’ll bring it up. This baby’s about to sell, there’s only 53 minutes left in this auction. Let’s take a look. Just click on the title and it’ll bring you into the auction. Currently it’s $19,299, looks like forty four bids have been made. That’s the auction info and then down here is the description of the vehicle. It says it’s in great condition. Then, if you go lower, you can click on the images and take a look at it. This denali does look like it’s in good shape… a gas hog, but it’s in good shape. You can look through all the pictures, click the X to shut it, then if you decide you want to bid on it you come on over here to the side.

Something you need to read and understand is how this works. It says “public surplus will place incremental bids for you up to the maximum amount you are willing to bid using proxy bidding. Your maximum amount is only visible to you. No other bidders will know what your maximum bid is. If there’s a reserve price, your bid will go to the reserve maximum, and then any amount of your bid over the reserve amount will be in a proxy bid.” It’s like eBay, if you’ve done eBay. Basically, you can put a maximum in there, and then it’ll keep bouncing up to your bid as long as you haven’t hit your maximum. Another important thing to read is right here. Remember, if you bid on these, and win, it’s yours… you have to buy it. So basically, you put your number in there, you hit submit, and you’re off and running.

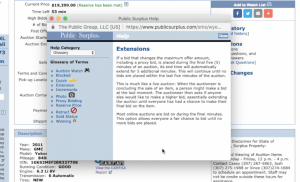

Some auctions might extend. There’s a slight difference between this and eBay. You know how it is on eBay… everybody rushes in at the last second and tries to win. This extension tries to avoid that. Basically, it gives everyone an opportunity. if you bid in the final five minutes of an auction, it’s end time will automatically be extended for five additional minutes. This will continue until no bids are placed within the last five minutes. That may mace make some of you upset… those that are used to eBay, but it makes it more fair and it’s not just a person who’s really good at getting that last-second bid in that wins. So that’s something to keep in mind for sure.

On a lot of these items there’ll be questions that are asked, and you can ask a question as well. You just click here… you can see what the questions are, and the answers. You can also ask a question by clicking here. Go ahead and type in your question and hit save and they’ll answer it for you. Okay, now you want to return to auction, and you want to put your $25,000 in there, and click Submit. That’s how you get it done.

Honestly, I hope that more people would subscribe to the idea of minimalism, and maybe not buy a bunch of stuff, but sometimes you just need stuff. So check out the state of Wyoming surplus property auction site to see if you can get a good deal! I’ll see you next time on the Subject Matter Minute.